Become a member of our Telegram Channel to stay informed of breaking the reporting

China’s Ant Digital Technologies, a unit of Jack Ma’s ANT group, stops for more than $ 8 billion in energy infrastructure on his own blockchain network.

That is according to a Bloomberg report This called sources that are familiar with the issue as saying that unity is busy token 60 billion Yuan ($ 8.4 billion) electricity infrastructure on the Antchain network.

The report said Ant Digital Technologies HSuch as monitoring the ability and malfunctions for 15 million new energy devices in China, including solar panels and wind turbines, and upload the data to its blockchain.

Ant Digital Technologies is planning to spend tokens for energy -infrastructure

It has already collected around 300 million Yuan ($ 42 million) to finance three clean energy projects. The unit is now planning to spend tokens that are linked to those assets.

One of the road map plans is to also offer tokens of offshore decentralized fairs (DEXs) to create more liquidity for the assets.

This will be subject to approval of the regulations, according to the anonymous sources that are cited in the report.

This is not the first step of the device to Tokenize energy assets. In August last year, Ant Digital Technologies collected $ 14 million for the energy company Longshine Technology Group and connected 9,000 of the company’s electric charging units to Antchain.

In December, the unit also assured more than $ 28 million for GCL energy technology by connecting photovoltaic assets with its blockchain.

RWA sector is rising high this week

The movement through ant digital technologies to spend energy assets and possibly tokens for them is part of a growing trend of the tokenizing of real-world assets (RWAS).

The sector is still in the early stages, but is starting to get speed. This week the value of Tokenized RWAS increased to a record high of $ 28.4 billion, data from Rwa.xyz Shows. This is almost double the value that is seen at the start of the year.

Rwa on-chain value (source: rwa.xyz)

More than half of the digital RWA value is a private credit that is cooled on the blockchain. More than a quarter of the value is also tokenized American treasurys.

Other tokenized assets include raw materials ($ 2 billion), institutional alternative funds ($ 1.8 billion), public equity ($ 421.2 million) and non-American government debt ($ 340.2 million).

The Ethereum -Blockchain remains the blockchain par excellence for Tokenized RWA -Emitents and has a market share of 57%.

Ant Group looking for the flowering stablecoin space

Ant Group is not only involved in the energy infrastructure space, but also wants to participate in the Booming Stablecoin market.

In July, one report said that the group is planning to include Circle’s USD Coin (USDC), which is the second largest stablecoin of market capitalization, to include in his blockchain network.

Ant Group also collaborated with E -Commerce Gigant JD.com to lobby the People’s Bank of China (PBOC) to approve Stablecoins, supported by the Chinese Yuan.

That happened in the same month that US President Donald Trump signed the Genius ACT in the law, which is the first bill at the federal level that sets the legal requirements for EGM in the US to meet.

Some of those requirements include maintaining a 1: 1 support in the underlying asset of the Stablecoin, as well as keeping anti-money laundering practices (AML) and against the fight against terrorism.

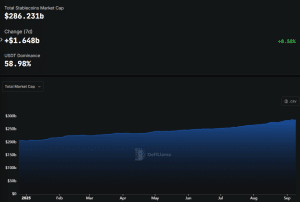

Since the Genius Act was signed in July in July, the Stablecoin market capitalization has risen from $ 260.715 billion to a record -high high $ 286,231 billion, according to Defillama facts.

Stablecoin Market Cap (Source: Defillama)

Just like with the RWA sector, Ethereum is the preferred blockchain for stablecoin -mittenten.

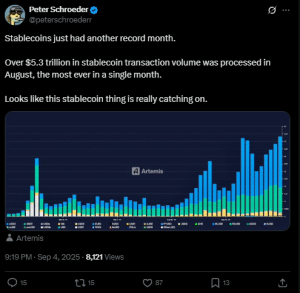

Stablecoin transaction volumes Spike in August (Source: X))

In addition to energy activa -tokenization and stablecoins, Ant Digital Technologies has also invested in a public blockchain called Pharos Network Technology. The project is led by a former ANT employee.

The unit has also concluded an agreement with a financial service provider in Hong Kong called Yunfeng Financial Group. As part of the strategic cooperation agreement, the two will use the Pharos platform to explore areas such as RWA -Tokenization.

Related articles:

Best Wallet – Diversity your Crypto -Portfolio

- Easy to use, with function driven crypto-wallet

- Get early access to upcoming token ICOs

- Multi-chain, Multi-Wallet, Non-requiring

- Now in App Store, Google Play

- Commitment to earn native token $ best

- 250,000+ monthly active users

Become a member of our Telegram Channel to stay informed of breaking the reporting

#Jack #Mas #Ant #Digital #Unit #Tokenize #billion #energy #assets