Yes.

Okay, I think you want a longer answer than that, so let’s look at one Analysis of the sustainability of public finances of the eurozone From 1995 to 2020. And while we are busy, we may want to compare it to the UK and the US.

So many investors, ironically especially in the Anglo-Saxon world, are obsessed with the countries of the eurozone and their non-durable fault and deficits. For me this always seems like a case of these investors who fight the last war because the situation has changed dramatically ten years ago since the European debt crisis. Nowadays, Italy and Spain have significantly reduced their deficits and the rest of this decade is expected to run very low shortages from 2% to 3% of GDP. In the meantime, Germany is the only major economy that is expanding its deficit because the infrastructure and defense expenditure increases. But nobody would not agree (or at least nobody who knows anything about economics) with the explanation that if a country can afford to borrow more, it is Germany. Admittedly, however, the shortages of France look untenably high.

In the meantime, the US is on track to have deficits above 7% of GDP work for the rest of the decade.

Deficits in large economies

Source: OECD, OBR, Tax Foundation

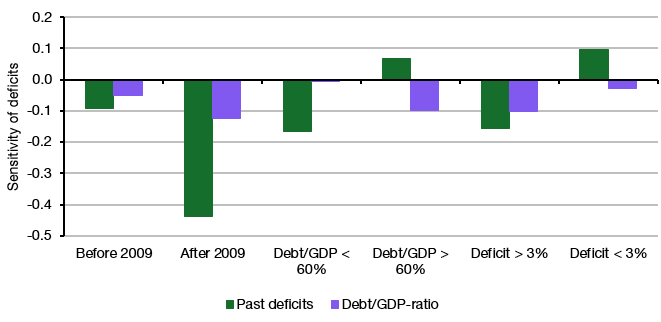

The European debt crisis has indeed done a lot of good things in the eurozone countries afterwards. The graph below shows the tax response function of countries in the eurozone for deficits in the past and debt-to-BP levels. The way to interpret these figures is that a negative number indicates that deficits have been reduced after an increase in deficits or debt levels in the past. The value itself gives you an idea of how much the deficit changes for an increase of 1% in earlier deficits or debt levels.

Tax response function of countries in the euro zone

Source: Afonso and Coelho (2025)

The most important collection meal is that in the eurozone deficits there are a tendency to decrease after debt levels or shortages increase. Eurozone shortage rules ensure that the government debt remains under control in the block. What I find particularly encouraging is that the study showed that shortage reduction is becoming stronger for countries with higher debt levels (> 60%) and those with a history of higher deficits in the past. And the sustainability of the debt increased considerably after 2009, which is simply a reflection of the tighter tax rules that were introduced during and after the European debt crisis.

By the way, this result immediately disputes the tax theory of the price level, as the authors point to it, but I will not enter that rabbit hole. You can read my opinion about that theory here.

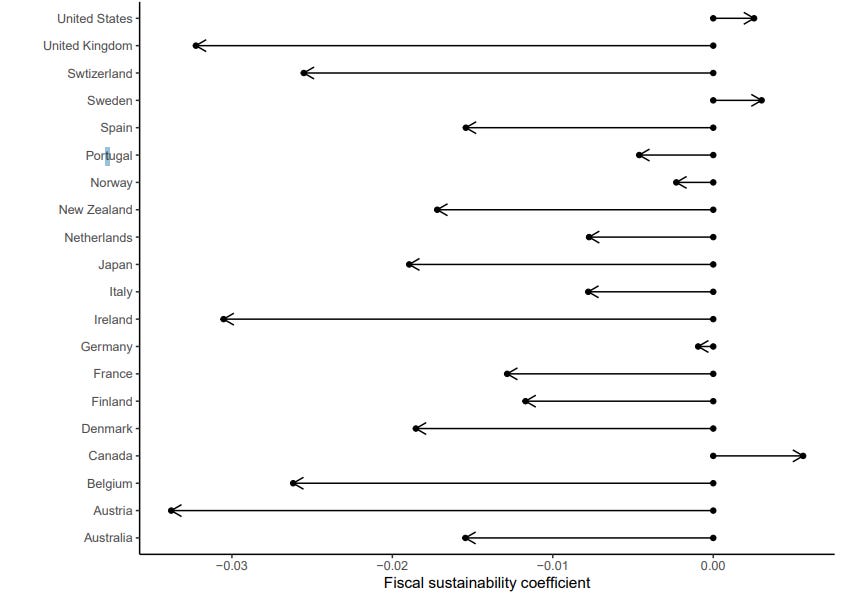

Instead, I want to contrast the tax responsibility of countries of the eurozone with those of the US. A few months ago, I wrote about another study Through the same authors, who investigated the tax response in the 19 largest economies. A graph that I did not shown last time is that below. It shows how tax responsiveness between 2000 and 2020 has changed by the country. As you can see, all Member States of the eurozone have become more tax -responsible (except Germany, which will probably become even more responsible than it was always). But the US, Canada and Sweden went the other way.

In particular, the US has become increasingly irresponsible, even though they already have large debts and shortages to start with. Is it a miracle that investors demands higher and higher yields About treasuries to compensate for the tax irresponsibility of American politicians? If you ask me, we will be at the start of another debt crisis, except that it unfolds on the other side of the Atlantic Ocean.

Estimated change in fiscal responsiveness 2000-2020

Source: Afonso et al. (2024)

#debts #eurozone #sustainable