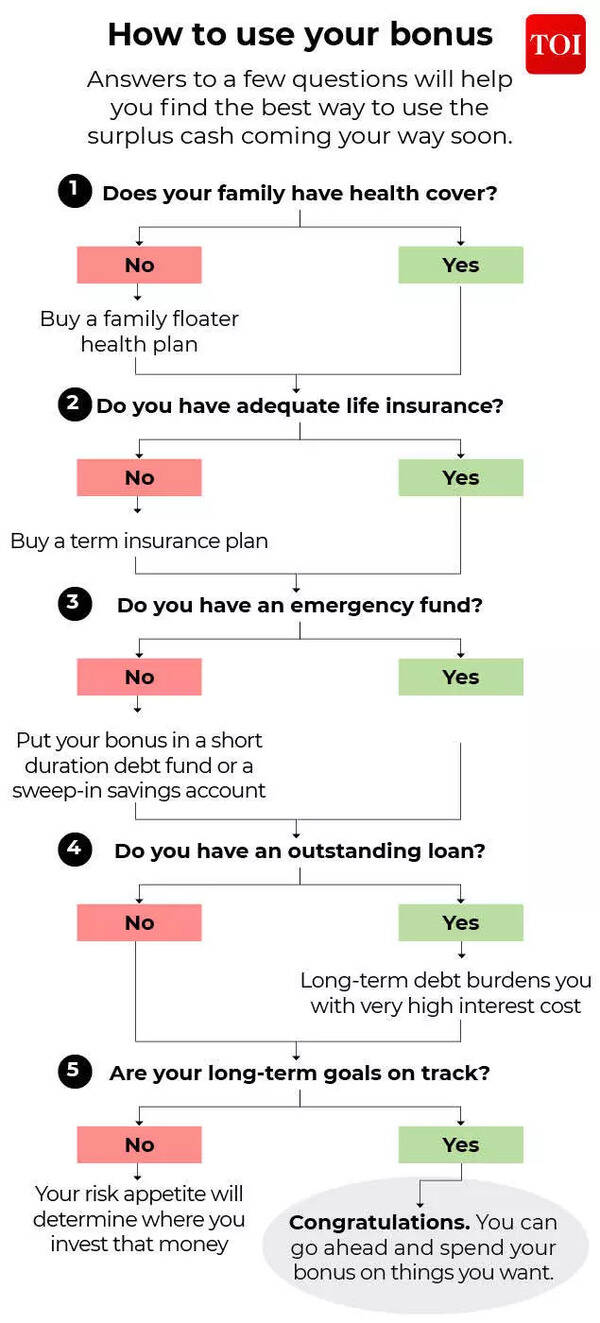

Answers to a few questions help you find the best way to use the surplus money that will soon be on your side.1. Does your family have healthcare?Do not rely on your employer’s group coverage because it may offer insufficient coverage.If your answer is no, then …Buy a Family Floater Health Plan to cover all family members. An RS 10 Lakh Floaterplan that covers a husband, wife and two children costs around RS 22,000-30,000 a year, depending on the age of the oldest member. Buy a company with a healthy claim scheme and a good reputation for customer orientation.If your answer is yes, then … go to the next question2. Do you have sufficient life insurance?Your life insurance coverage must be at least 8-10 times your annual income and outstanding loansIf your answer is no, then …Buy a term insurance plan that you cover up to the age of 60-65. You could buy a single premium plan that pays the entire premium in one go. A 35-year-old can get a coverage of RS 1 crore for 25 years by paying RS 2.5 Lakh. The entire bonus will go into this, but this one payment ensures your insurance needs for the rest of your working life.

How to use your bonus

3. Do you have an emergency fund?You must have enough to cover 3-6 months, including Loan EMIs and insurance premiums.If your answer is no, then …Place your bonus in a debt fund of short duration or a sweep-in savings account. You will not earn too much, but returns are not important here. Also do not dive into this fund unless there is a real emergency. If you are used for an emergency, supplement the fund as soon as you get sufficient liquidity.If your answer is yes, then … go to the next question4. Do you have an outstanding loan?By paying such loans you can save more than what you earn from options with a fixed incomeIf your answer is yes, then …Long -term investments build up wealth, but the long -term debt tax you with very high interest costs. Although the policy rates have been reduced, the rates for housing loans have not fallen too much. Use your bonus to pay off your outstanding housing loan. Prepaying four EMIs can reduce the term of office of a loan of 20 years by almost two years.If your answer is no, then … Go to the next question5. Are your long -term goals on the right track?Use the surplus cash to save for the higher education of your child or your pension If your answer is no, then …Your risky appetite will determine where you invest that money. If your risk appetite is high, go for Equity investment funds. It is not a good idea to invest a large amount in stock funds in one go. Place the money instead in a debt fund with short duration and start systematic transfers in a stock fund. Payed advantage funds match moderate investors, while investors have to go with a low risk for PPF.If your answer is yes, then …Congratulations. You have treated all your needs so that you can spend your bonus on things you want.

#bonus #Answer #questions #times #India