Don’t miss it – make us online for the monthly market degradation of brake on 26 August at 2 p.m. et. REM, columnist Daniel Foch analyzes the latest statistics from Crea, regional variations and what shifting sentiment means for brokers – register here.

A shift is led on the housing market of Canada, subtly enough to be missed in the noise and yet powerful in its implications. Signals from July suggest a rehabilibration in the balance between the solution of the buyer and the ambition of the seller.

National home sales climbed 3.8 percent from June and marked the fourth consecutive monthly increase. Since March, transactions have risen by 11.2 percent, with the larger Toronto area leading to 35.5 percent growth in that period.

For the informal observer it may seem as if the long -awaited recovery is here. In reality this is a different kind of movement. The driver is not exuberance or a sudden relaxation of loan costs. The current lift in transactions is rooted in price adjustments and that distinction is more to do than it seems.

This is especially clear in the observation of Crea that an increase in transactions in the Greater Toronto area played a major role in the national sales volume that went up. We know that prices are falling the strongest in the GTA, so it would be reasonable to assume that there is a strong correlation between reduced prices, which leads to more affordability, so that buyers create more opportunities to enter the market.

Will the same trend be needed for the rest of Canada to see sales growth?

The narrowing of the gap

BMO -capital markets has been clear about what the market stops: the distribution between what sellers want and what buyers are willing to pay. Robert Kavcic, senior economist, describes it as a “wide bid-ass-ass-spread” that has prevented the market from erasing, so that lists stay away. The only sustainable remedy is to close that gap.

There are three theoretical ways to achieve this. The first is forced to sell, for which a deep recession, rising standard values and job losses would require, a scenario neither threatening nor desirable. The second is a substantial decrease in mortgage interest in the low reach of three percent, for which a reduction of around 100 basic points of current levels is required. That path is considered unlikely in the short term.

The third is price reductions. BMO regards this as the most realistic outcome. RBC Comes to a similar conclusion and notes that moderation of prices in different regions has yielded the greatest affordability improvement in three years, so that more buyers are encouraged to act.

This is proof. The MLS® Home Price Index of July was unchanged from June, but 3.4 percent lower than a year earlier. In the GTA the values in 12 months have fallen by 5.5 percent; Vancouver drops by 2.8 percent and Calgary, a long exception to the rule, is now 1.8 percent lower. The modest relaxation of the prices is sufficient to get more buyers back on the market.

Price movements such as the actual lever of affordability

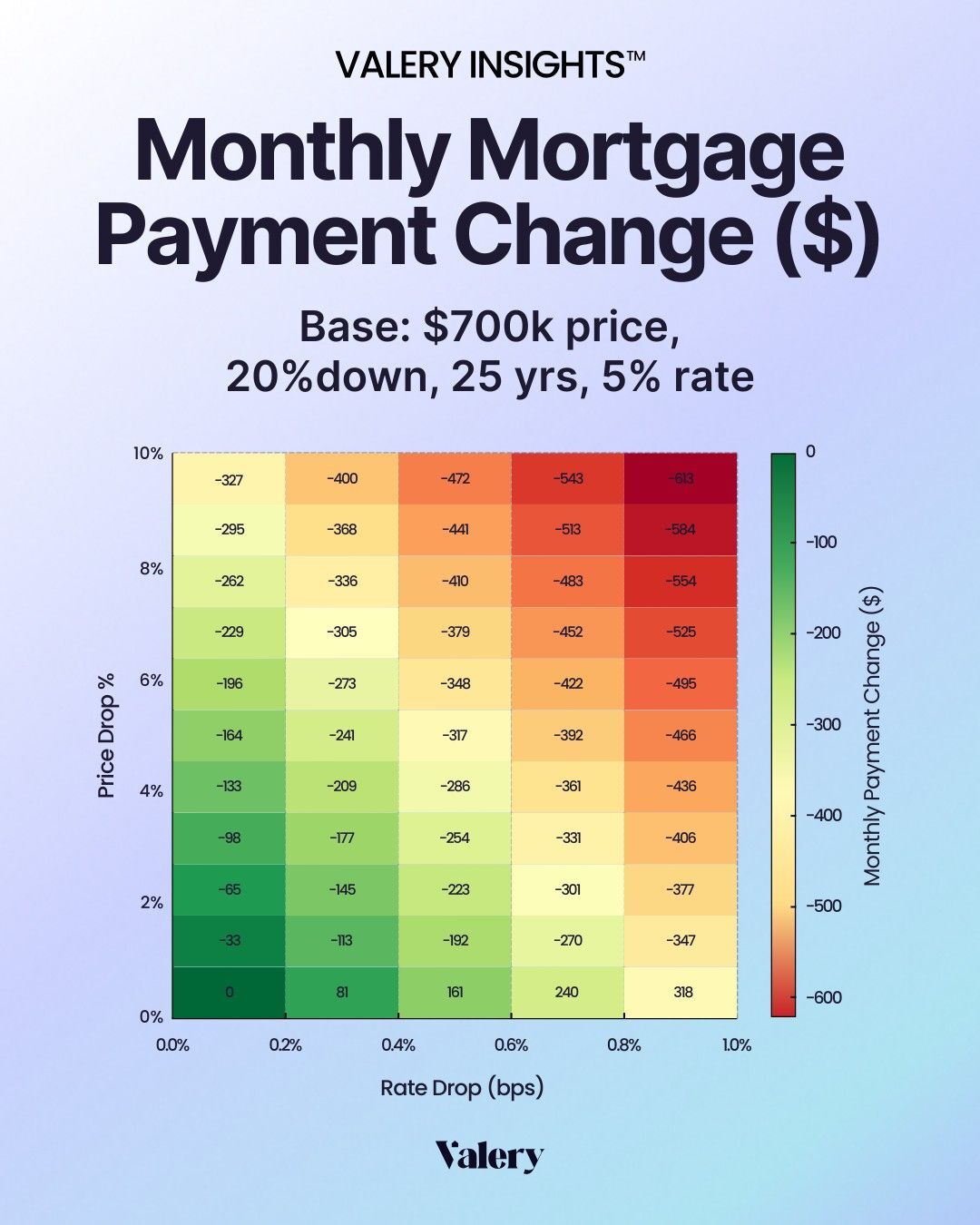

In the current interest rate environment, the arithmetic of affordability that the price drops compared to the reduction of the marginal rate drops. Consider a house of $ 700,000 by 20 percent lower, an amortization of 25 years and a mortgage interest of five percent. A price drop of five percent reduces the monthly payments by around $ 165. For comparison: a reduction of the interest rate of 25 base on the same house saves around $ 58 per month.

The implication is simple: in the short term, further prices of prices will have a greater influence on the unlocking demand than incremental movements by the Bank of Canada.

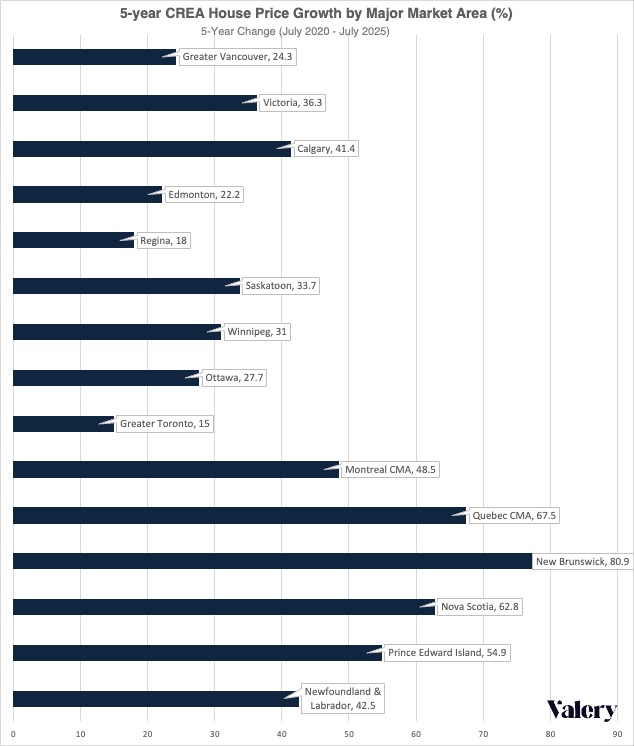

Price growing patterns are sharply varied in Canadian cities. Toronto, Vancouver and now Calgary all have registered price decreases on an annual basis. The price performance of Toronto in the past five years are the weakest among large Canadian markets, an increase of just over 15 percent, while New Brunswick leads with a profit of 80.9 percent since July 2020. In the past three years, Toronto has also experienced the best price decrease among large markets, while Quebec City has placed the strongest profit.

Canada’s Splitcreen Inventory Photo

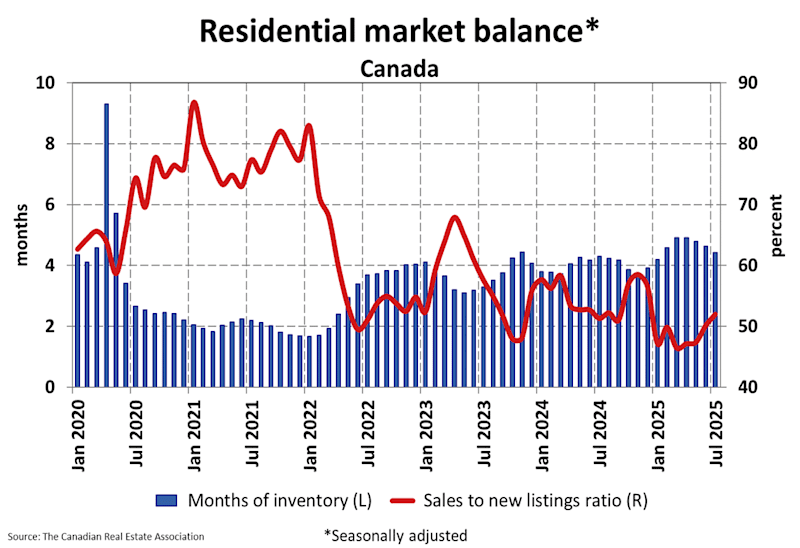

The new offers from July were essentially unchanged compared to June, but the active inventory was 10.1 percent higher than a year earlier. Nationally there was 4.4 months of inventory, a figure that was consistent with balanced circumstances. Yet regional differences are striking.

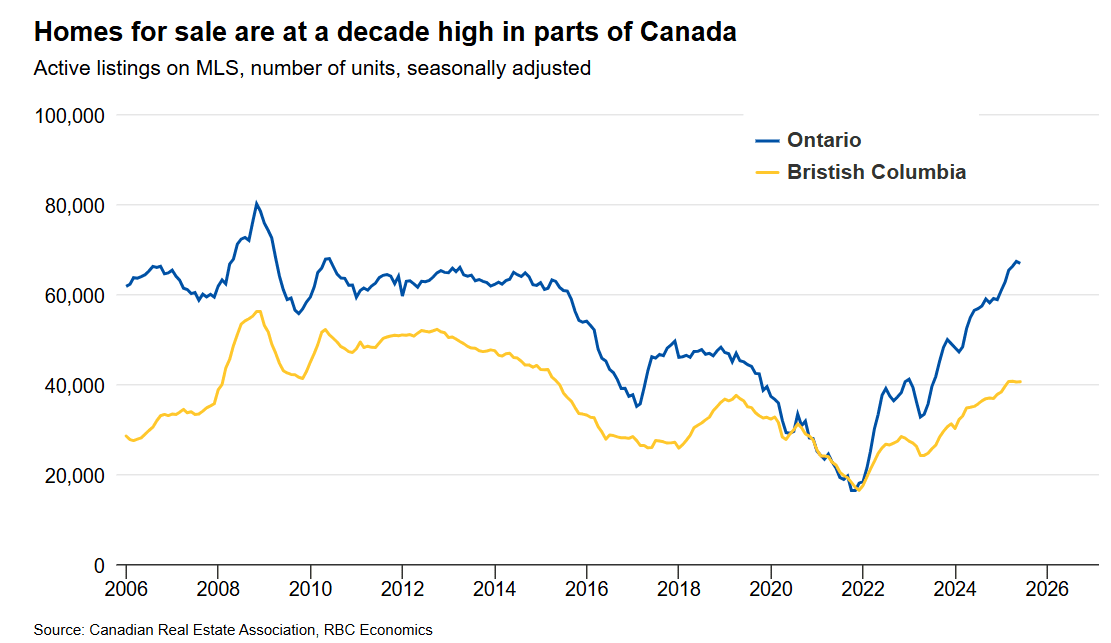

RBC Economics In the same report referred to above, notes that Ontario and British Columbia bear the highest inventory in a decade, a situation that has promoted intense competition among sellers and is expected to retain the prices for pressure in 2026. In the prairies, Quebec and Atlantic Canada, Inventory in some cases remains under the pre-Pandemic standards. These differences explain why price corrections unlock the demand in certain provinces, while others remain floating.

The September test and the road to a sustainable recovery

The influx of new entries from September will test the solution of the market. CREA emphasizes this as a crucial moment, when the balance between the buyer’s demand and the supply of the seller could retain recent profit or enforce further price concessions.

The result is important because the recent lift in sales reflects opportunities instead of exuberance. With the mortgage interest still high, the price adjustments are the most powerful lever for unlocking demand. In many important markets, values have just decreased enough to restore a degree of affordability, so that they are pulled buyers in the back of the fold. For the Bank of Canada is the clearest path to a long -term recovery that does not recover inflation to make this process of price normalization possible, instead of relying exclusively on marginal speed reductions.

Daniel Foch is the Chief Real Estate Officer at Valery.ca and host of Canada’s #1 real estate podcast. As a co-founder of the Habistat, the built-in Data Science platform for Trreb & Stoptx, he helped the real estate sector to become more transparent, using real-time housing market data to inform decision-making for important stakeholders. With more than 15 years of experience in the real estate sector, Daniel has advised a broad spectrum of participants in the real estate market, from 3 levels from the government to some of the largest developers in Canada.

Daniel is a familiar voice in the Canadian real estate market and regularly contributes to media such as the Wall Street Journal, CBC, Bloomberg and The Globe and Mail. His expertise and balanced insights have delivered him a dedicated audience of more than 100,000 real estate investors on several social media platforms, where he shares primary research and market analysis.

#Foch #sale #Canadian #home #increasing #prices #falling