The average actively managed fund performs the market, as we know. But how does the average fund manager waste the performance? Is it by choosing the wrong shares or by investing in the right shares, but at the wrong time?

Javier Vidal-Garcia and Marta Vidal An attempt to find out by dissolving the return of more than 21,000 active stock funds that invest in 35 different countries between 1990 and 2025. Because they only watched funds in one country instead of regional or global funds, the total assets that were among these funds among most countries) were.

The graph below shows the results of this return decoration for funds in selected countries, compared to the total market performance in every respective country. As you can see, the primary engine of underperformance is the timing of stock purchases and sale, instead of choosing stock itself. In each of the 35 markets studied, fund managers lost on average performance due to their market timming activities. The resistance of market timing was on average 0.43% per year. In the meantime, picking in some countries has contributed positively and negative with others. Yet there was no clear trend and the average of the 35 countries tested was somewhat positive with 0.09% per year.

Return contribution of active funds versus total market

Source: Vidal-Garcia and Vidal (2025)

But this is not the whole story. Most funds are managed against a benchmark that is limited than the market in general. The typical benchmark is the MSCI index that covers the respective country. So they did the same decomposition for the MSCI Country Index versus the total market.

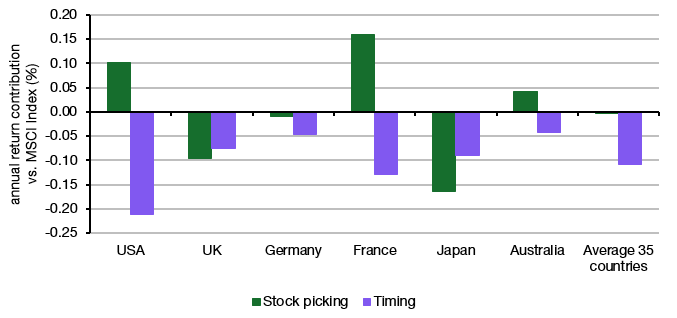

In the graph below I calculated the difference between the average fund manager and the MSCI Country Index to determine where fund managers are underperforming in comparison with a typical benchmark index instead of the market.

Return contribution of active funds versus MSCI Country Index

Source: Vidal-Garcia and Vidal (2025)

As you can see, MarktTiming is still the primary engine of UnderPerformance. Indeed, on average in 35 countries, this is the only engine of underperformance. In the meantime, storage choices is sometimes positive and sometimes negative, but on average it is not detracted from the performance of a fund versus the MSCI.

The results are not great for active fund managers, because on average the share voters are unable to add value by share choices (although some can clearly). However, it suggests that fund managers who want to improve their performance may want to concentrate more on refining their market timing decisions instead of selecting the right shares. This analysis suggests that more ‘Alfa’ can be found by refining the investment process around timing decisions rather than decisions about share choice.

#fund #managers #lose #performance