The study used the example of the 2011/2012 European debt crisis as a testing ground for the transmission of European shocks abroad. The playbook is always the same and familiar to experienced investors. Although crises such as the European debt crisis or the 2008 financial crisis are now so distant that many investors will not have first-hand experience with this type of contagion.

Let’s say Europe is embroiled in a debt crisis in which credit spreads on some bonds (in 2011 they were Greek, Italian, Portuguese, Spanish and Irish bonds, but today they could easily be French bonds) are rising compared to the safer bonds issued by Germany. This means bond funds are making losses and facing redemptions from panicky investors. Fund managers then have to sell some of their assets to free up money that they can return to investors.

Typically, fund managers don’t want to sell bonds that have suffered excessive losses, so they look for other liquid assets in their portfolios to sell. As a result, they sell Asian and US bonds, spreading the selling pressure to these markets, even though there is no fundamental reason why bonds in these markets should sell off.

Easy enough. And as you can imagine, that’s exactly what happened in the bond markets in 2011 and 2012. International bond portfolio managers were faced with client redemptions and had to sell some of their portfolio assets.

Below is a graph of the average decline in Asian bond holdings in international bond fund portfolios over the six months after the European periphery credit spread increased by 10 basis points. The left chart shows that in the three months following a eurozone credit shock, Asian government bond holdings in funds fell by about 1.5 percentage points and then rose again. Overall, the weights of the Asian bond portfolios (government and corporate bonds) declined more slowly over time, but were about one percentage point lower after six months.

Effect of the Eurozone credit shock on Asian bond investments

Source: Longaric et al. (2025)

It is no surprise that government bond holdings first decrease and then build up again as corporate bonds decline, as government bonds are generally more liquid than corporate bonds.

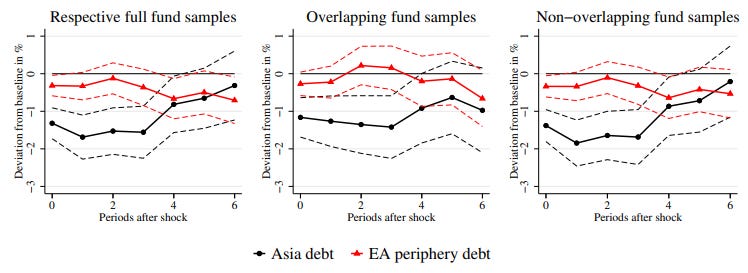

What surprised me, however, was the comparison between the decline in positions in Asian bonds and positions in bonds from the European periphery in the portfolios. As you can see in the chart below, positions in Asian bonds have fallen by about three times as much as positions in European peripheral government bonds. As for European bond fund managers, when Europe sneezes, they sell Asian bonds much faster than European bonds, ensuring that Asia does indeed catch a cold.

Effect of the Eurozone credit shock on the holdings of bonds from the peripheral countries of Asia and the Eurozone

Source: Longaric et al. (2025)

#Europe #sneezes #Asia #catches #cold