In 2022, after the Russian invasion of Ukraine, I tried to estimate it how effective the sanctions against Russia would be and how long Russia could live under these sanctions before running out of money. In light of an interesting new study on the economic impact of sanctions by Martin Bernstein and his colleaguesI wanted to revise that prediction from three years ago.

I said that Russia’s GDP would fall by almost 10% over the next twelve months, and that if the international community sanctioned Russia’s oil and gas exports, Russia would be on its knees within one to two years. On the other hand, if Russia can continue to export oil and gas, it will be able to withstand the sanctions for a very long time.

Within 12 months of the sanctions, Russia’s real GDP in US dollars fell by 10%, as the chart below shows, and now the Russian economy is about 23% smaller than it was at the end of 2021. But of course, Russia did not run out of money within two years, especially as the country continues to export its oil to China, India and other countries and its natural gas in the form of LNG to a range of countries, including Germany.

Russia’s real GDP has fallen significantly since the start of the war

Source: Panmure Liberum, Bloomberg

Note that even though Russia was subject to extremely strict sanctions, which affected a large part of its economy, the country can withstand these sanctions quite well and for a long time. Typically, the sanctions imposed on a country are much smaller than those documented by Bernstein et al. They examine a total of 535 trade sanctions between 1870 and 2020 to assess the typical effect on a sanctioned economy.

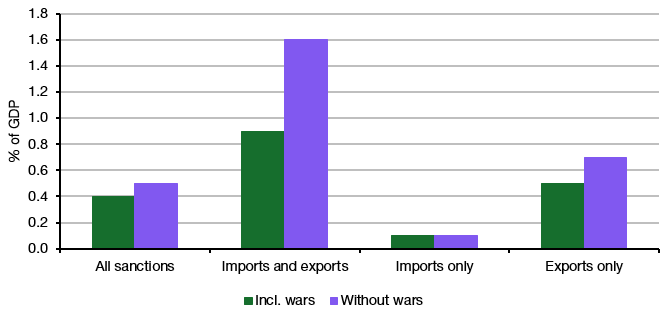

Their data shows that while there are some excessive examples that distort the average share of GDP affected by sanctions, the average sanctioned share of the economy is around 0.5% of a country’s GDP.

Median share of the economy affected by sanctions

Source: Bernstein et al. (2025)

In the case of export sanctions, the share is usually larger, at 0.5% to 0.7% of a country’s exports, but the sanctions still target only a small part of the economy. And this means that the economic impact of these sanctions is also small.

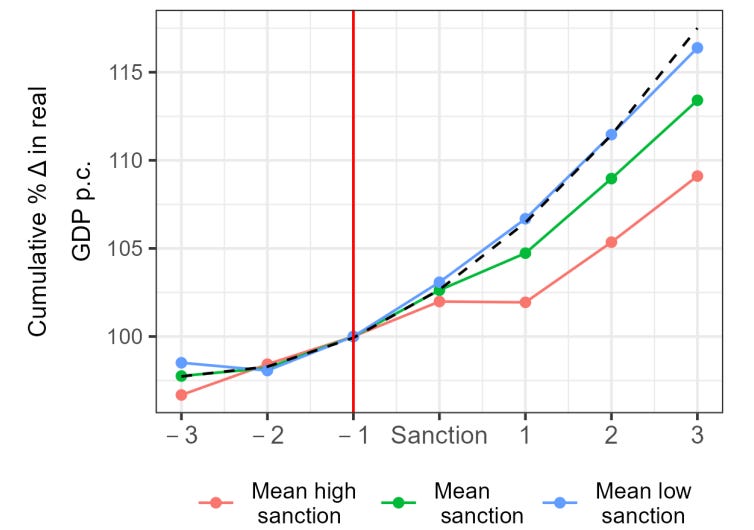

The graph below shows the loss of GDP at low, medium and high sanctions. Low sanctions in this context mean the average economic impact of sanctions below the median, and high sanctions mean the average economic impact of sanctions above the median. With low sanctions there is no impact on the GDP of the sanctioned country, while with large sanctions this amounts to approximately 5% of GDP in the first four years. The average sanction reduces GDP by 1% to 2% in the first four years.

Economic impact of sanctions

Source: Bernstein et al. (2025)

The study authors hasten to point out that these are averages. For countries with highly concentrated exports or imports, the economic impact can be three to four times greater, simply because sanctions targeting these crucial trade flows have an outsized impact on the sanctioned country.

But I have to wonder, do we ever have the guts to impose such draconian sanctions? We certainly shied away from effective sanctions against Russian oil and gas exports. Would we really impose draconian sanctions on other major oil exporters like Saudi Arabia or on major exporters like China? I doubt it. And that means that while sanctions may work in theory, they are only used in a meaningful way against smaller countries with little global impact. The big boys can largely do what they want, because most countries do not want to impose sanctions that would impose significant costs on them.

#Sanctions #work