Clearlyknown for millions of Italians to allow their favorite items in three episodes without interest, now also offers different solutions from storage accounts. The people who therefore evaluate the hypothesis of opening a new account now have an extra option to make their savings.

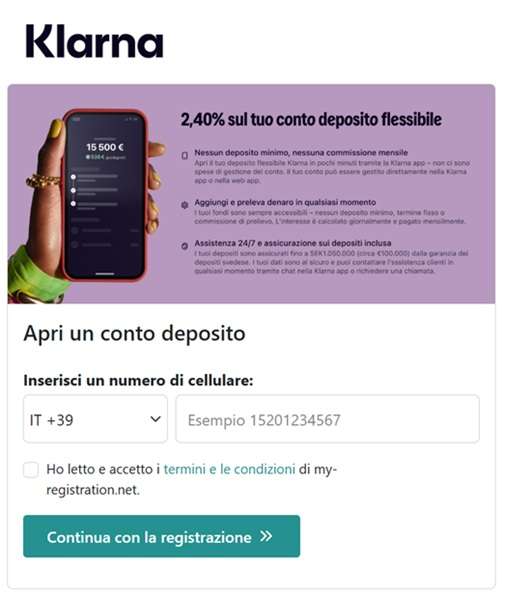

Yes, but how much? The Klarna Flexible deposit account This allows you to 2.40% on the deposed amountswithout a minimum amount required or monthly committee. In addition, the owners of the account can add and withdraw money at any time, whereby the interest is calculated from day to day and paid monthly.

The benefits of the Klarna deposit account

Nowadays, most deposit accounts of traditional banks offer the “zero point” of interests on their savings, a negligible percentage that has pushed an increasing number of people from these solutions. Now Klarna arrives, who with its 2.40% of the interest rate generous percentage To those who were previously burned through the policy of classic banks.

However, it is not just a matter of percentages. Another aspect in which the Klarna deposit is preferred over traditional accounts flexibilityWhat translates into three important points:

- No minimum amount

- zero committees

- addition and withdrawal of money at any time

On the contrary, a large number of banks require a minimum amount to open a deposit account, which is often and willingly also bound to a top month (6 or 12 months).

Finally, the list of benefits is added to the protection of someone’s savings. The latter comes directly from Warranty of Swedish depositsFor an amount of up to 100,000 euros.

How to open a new down payment

The opening of a new deposit account requires the Connection to the official Klarna website or to the app of the famous Scandinava Fintech, the recording of your telephone number and the selection of the button Continue registration. The procedure is completely online and only requires a few minutes of your free time.

#Klarna #market #storage #accounts #option #savings #fruit