Over the last (almost) 100 years, since 1926, US small-cap stocks have outperformed large-cap stocks by 2.85% per year. So they performed better in the long term. But, like Edward McQuarrie emphasizes that these long-term averages mask extremely long periods of underperformance, which could easily last a decade or two.

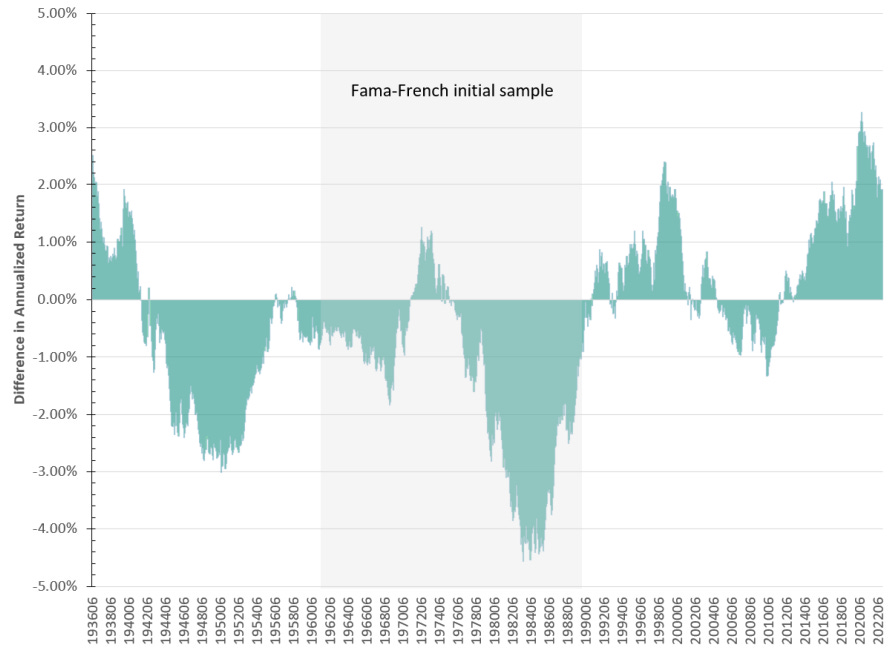

Just look at the breakdown of US small cap versus large cap performance over a twenty-year period below. While small-cap stocks outperformed every twenty years between the 1930s and the 1970s, they significantly underperformed in the last two decades of the twentieth century.e century and again since 2018. If you had invested in US small caps over the past forty years, you would have barely managed to keep pace with large cap stocks.

Performance difference between US small caps and large caps

Source: McQuarrie (2025).

That’s why I’m always skeptical when I see people citing the Fama-French data on factor performance since 1926. None of us have been an investor since 1926, and even for endowments and pension funds, a hundred years is an awfully long time to wait for your statement to come true.

It reminds me of a quote from a computer science professor of mine (admittedly, it was a quote from the 1990s, but bear with me): “In practice, it doesn’t matter if a computer can never solve a problem or if you have to wait five minutes in front of the screen.”

Likewise, if an investor has to wait ten years or more for a factor like value or size to work, it might as well never work, because by then the vast majority of investors are no longer invested in it.

And this is the core message of McQuarry’s note. As in his excellent discussion of long-term performance differences between stocks and bonds (see here, hereAnd here), he shows how long ‘the long term’ can last in practice. To paraphrase Keynes: Factors can stop working longer than you can remain solvent.

A nice graph in his new article is that academic results themselves can be subject to false identification. Take a look at the chart below that shows the performance of highly valued US large-cap stocks versus the value of US small-caps. The first sample Fama and French used to identify size and value as best-performing drivers coincides with a relatively unique period in the past hundred years when expensive large-cap stocks in the US significantly underperformed. Over the past 35 years since their research was published, expensive large-cap stocks in the US have almost consistently outperformed small-cap value stocks, regardless of the ten-year investment horizon you choose.

Which brings me to a provocative question: If we knew nothing about factor investing today and were just looking at it for the first time, would we still conclude that value stocks outperform over the long term? Can we conclude that small-cap stocks perform better in the long term? What about big, expensive stocks versus small value stocks?

McQuarrie gives his answers in the note. So check it out if you’re interested, but think about it for yourself before you do. What is your conclusion given the data shown here?

10-year rolling performance of large, overvalued US stocks versus small-cap value stocks

Source: McQuarrie (2025).

#long #long #run