The crypto market has cleared more than $19.5 billion in leveraged positions in the last 24 hours, making this the most chaotic 24-hour period in crypto history. This crash, which forced 1.6 million traders to exit their positions, was caused by a sudden crash US Tariff Announcements on China and reinforced by risky leverage on the stock markets.

Bitcoin alone witnessed a daily swing of $20,000 and erased $380 billion in market capitalization in a single day. This liquidation surpassed all previous records by nearly tenfold, surpassing the records set during the FTX collapse and March 2020 crash.

Related reading

Liquidations are rippling throughout the crypto market

The most recent crypto market crash has taken many crypto investors by surprise. Remarkably, data shared by The Kobeissi letter on the social media platform To put that in context, the February 2025 liquidation only wiped out $2.2 billion, while the May 2021 crash wiped out $1.2 billion.

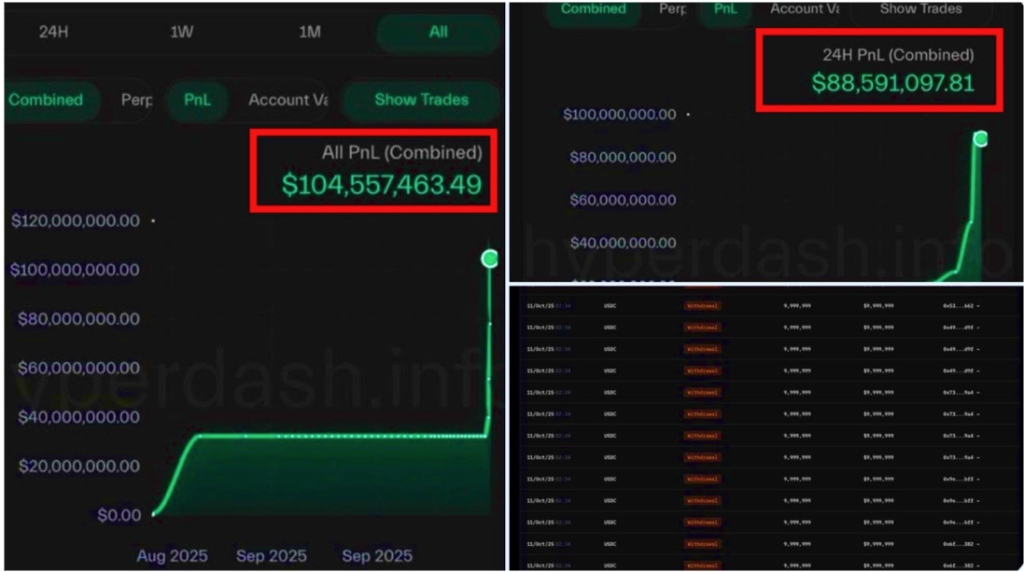

Data from major exchanges confirmed that the sell-off was highly one-sided. Of the $19.38 billion in total liquidations, $16.7 billion came from long positions, which is a 6.7 to 1 ratio compared to short positions. Nearly every exchange, from Binance to Bybit, saw more than 90% of liquidations reach longs, with Hyperliquid alone trading at $10.3 billion.

Liquidations of Crypto Exchange. Source: @KobeissiLetter on X

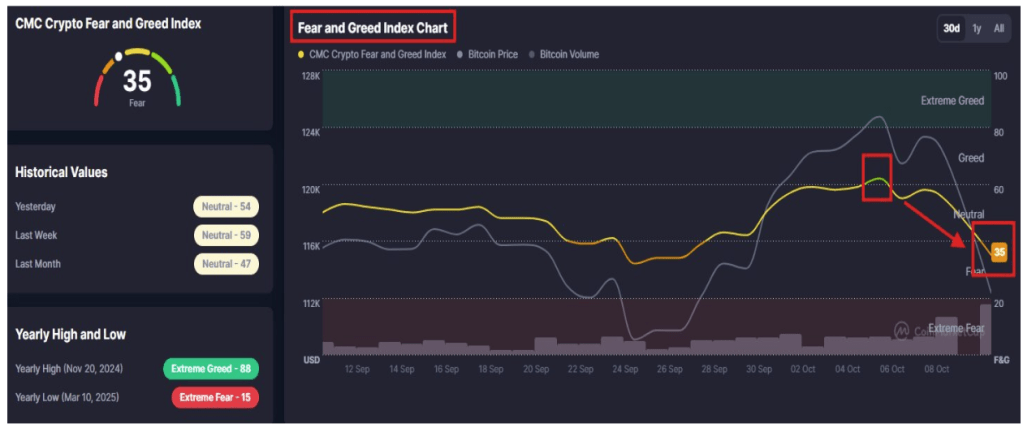

This rapid decline is quite remarkable considering that the crypto market’s greed index had climbed above 60 when Bitcoin’s price action broke above $126,000 for the first time.

Crypto Fear and Greed Index. Source: @KobeissiLetter on X

What caused the crash?

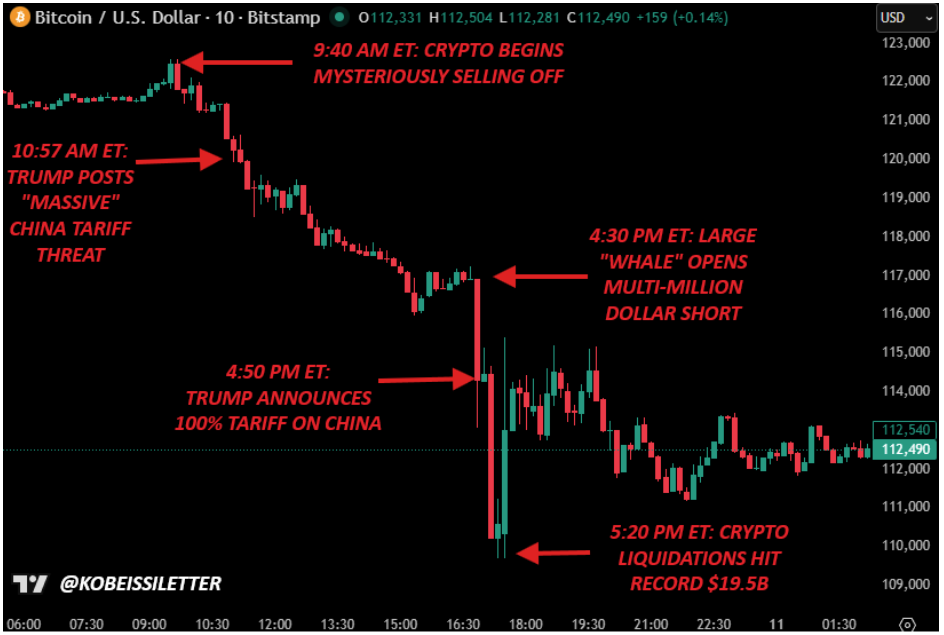

The reason behind the crash can be attributed to a mix of extended market corrections following Bitcoin’s record high and rising tensions over new US tariffs on China. According to The Kobeissi Letter, the sell-off occurred through a series of perfectly timed events that linked geopolitical shocks to fragile market sentiment.

At 9:40 am ET, some major Bitcoin holders mysteriously started sellingmore than an hour before former US President Donald Trump posted at 10:57 am about a huge threat of Chinese tariffs. Later in the day, at 4:30 PM, a large whale opened multi-million dollar shorts, seemingly anticipating the coming decline. Just twenty minutes later, Trump officially announced a 100% tariff on China, delivering the final blow to bullish sentiment.

Chronology of events. Source: @KobeissiLetter on X

Trump’s tariff post came late on a Friday after US markets closed, but the crypto market was wide open. As such, crypto prices fell into a vacuum when volume spiked, setting the perfect stage for one of the fastest collapses in crypto history. By 5:20 p.m., total liquidations had reached $19.5 billion, and the whale closed its positions for a profit of $192 million.

Despite the massacre, The Kobeissi Letter noted that this event was technical rather than fundamental. The crash is a necessary reset that has no long-term consequences. A trade deal between the US and China would end the uncertainty, according to the team crypto remains strong.

Bitcoin price chart. Source: @KobeissiLetter on X

Related reading

At the time of writing, Bitcoin has recovered somewhat from its plunge and is now trading at $111,790.

Featured image from Unsplash, chart from TradingView

#Crypto #Crash #Billion #Wiped #RecordBreaking #Liquidation #Event