Six months ago, I wrote about an interesting article from the ECB that examined the increasing impact of geopolitical fragmentation on global supply chains. At the time, I explained that the US has increasingly decoupled from China since 2016, while the EU has increased its imports from China but quickly decoupled from Russia after the invasion of Ukraine.

At the ECB Forum in Sintra at the end of June Ana Maria Santacreu presented a similar analysis. What makes her research worth late-night reading (in case you’re having trouble falling asleep) is that she provides more detail about who replaced who and who lost as China’s role in global manufacturing increased.

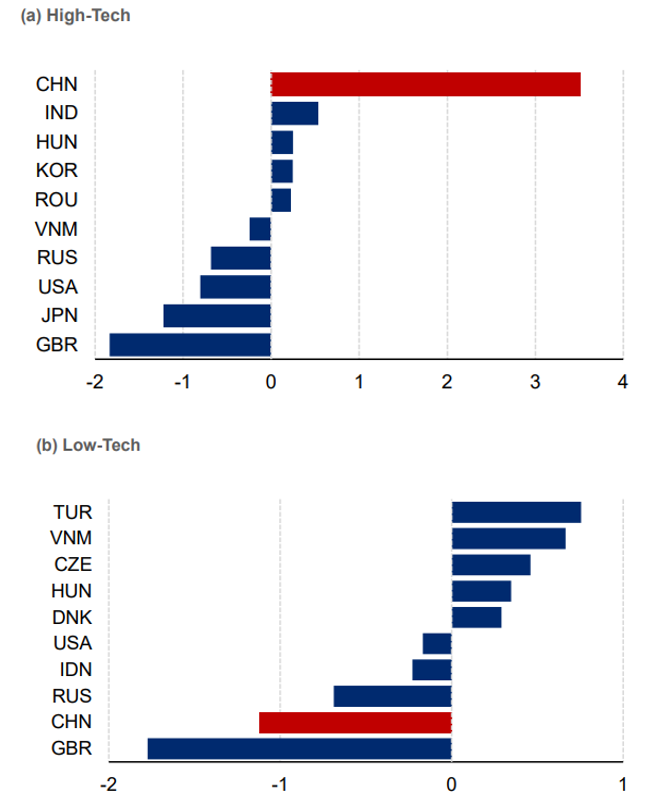

The first chart below illustrates the change in U.S. import shares between 2017 and 2023, broken down by high-tech and low-tech goods. As you can see, American companies have been decoupling from China across the board. They mostly replaced Chinese suppliers with suppliers in Europe, Vietnam and Korea for high-tech goods, but Canada (surprisingly), Vietnam and Mexico for low-tech goods.

Change in US import share 2017-2023

Source: Santacreu (2025)

For the EU the picture is more complicated. Certainly, the two big losers were Russia and Britain, the former because of the invasion of Ukraine, the latter because of Brexit. However, keep in mind that the Chinese stock moved in opposite directions depending on the type of goods you look at. European companies import fewer low-tech goods from China than before and have increasingly replaced Chinese supplies with goods from Turkey, Vietnam and within the EU (Czech Republic, Hungary, Denmark).

But in the high-tech field, imports from China rose more than those from any other major trading partner. Meanwhile, Britain, Japan and the US lost. When it comes to the EU as a market, China has benefited at the expense of Britain, Japan and the US.

Change in EU import share 2017-2023

Source: Santacreu (2025)

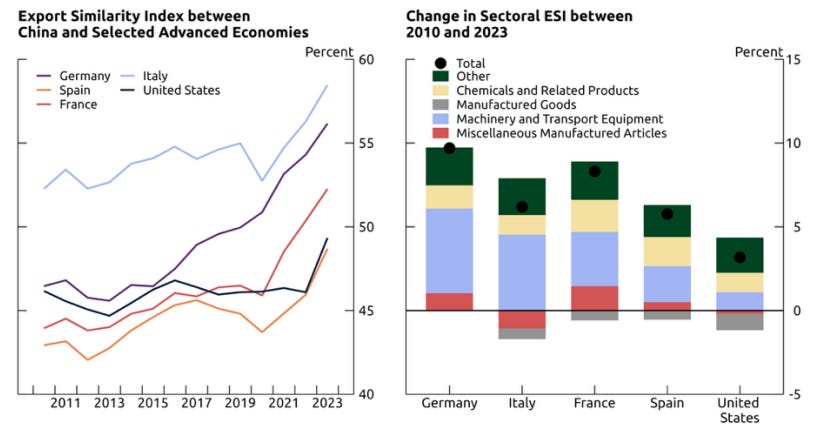

From a global perspective, however, it was mainly the heart of Europe that lost when the Chinese market share increased. These countries have certainly lost much more than the US. To see why, we can look at Santacreu’s calculation of the export similarity index between China and other major exporters. This index measures how closely China’s exports, sector by sector, resemble those of another country.

The charts below compare the export similarity of Chinese goods with other major economies. Clearly, Chinese exports are not all that similar to American exports. Instead, Chinese exports are increasingly competing with Germany and Italy. And the increase is mainly due to the machinery and transport equipment sector, and to a lesser extent to the chemical industry.

Trade similarity index between China and other industrial countries

Source: Santacreu (2025)

About a year ago, the German Economic Institute surveyed German business leaders about their perceptions of Chinese competitors. And the German business elite did not hold back. They were open about the fact that while Chinese competitors are typically 10% to 30% cheaper than German manufacturers, they also noted that a significant number were more innovative than their German counterparts. The result? Two-thirds of business leaders surveyed said they are losing market share to Chinese competitors.

What do they say in Alcoholics Anonymous? Admitting that you have a problem is the first step to overcoming it. At least German business leaders admit they have a problem with high-end Chinese competition. This can give them the motivation to become more innovative in the future.

In the past decade or more, I don’t recall any American business leaders recognizing the same thing. Instead, they decided to compete with China on price and tried to do so save as many costs as possible, instead of investing in a better quality product. And that led to further decline and a huge political backlash in the form of Donald Trump.

#China #rose #fell