CEOs behave poorly

It is amazing when a board of directors goes “All in” with their chief executive officer (CEO). And a short time later, despite assessments from “independent external advisers” that no accusations were substantiated, the drivers do a collective about the face and end the employment of the CEO.

Take Super Retail Group (ASX: SUL) as the most recent example. The owner of Rebel Sport, Boating Camping Fishing, Supercheap Auto and Macpac brands, Super Retail Group has a market capitalization of $ 3.7 billion and has $ 4.1 billion in sales and $ 400 million in income before interest and taxes (EBIT) for the year to June 2025.

The Super Retail Group Board was “All In” with CEO Anthony Heraghty, when they issued their appendix 4th and 2025 annual report on Thursday 21 August. Only 26 days later we witnessed the “Mea Culpa” – the big reversal.

Super Retail Group, and his former chairman, Sally Pitkin, are sued by Rebecca Farrell and Amelia Berczell about claiming that they were being bullied and harassed after submitting whistleblower complaints. Judge of the federal court, Michael Lee, who is used to dealing with poor business behavior after recently fined by Qantas $ 90 million, has been active in cases where CEO behaves poorly. Justice Lee has emphasized his determination in streamlining the procedure, while the complexity and costs for all parties involved are reduced.

Super Retail Group’s most important disclosures of Corporate Governance, also released on the ASX Follow on Thursday, August 21, 2025.

- Principle 1: Lay a solid basis for management and supervision

- Principle 2: structure the board to be effective and add value

- Principle 3: Install a culture of lawful action, ethically and responsible

- Principle 4: Protection of the integrity of business reports

- Principle 5: Make timely and balanced disclosure

- Principle 6: Respect the rights of security holder

- Principle 7: Recognize and manage risk

- Principle 8: Reasonable and responsible reward

It now seems that the Super Retail Group directors have failed many of these fronts and those who came to the board before 2024 should consider falling on their sword.

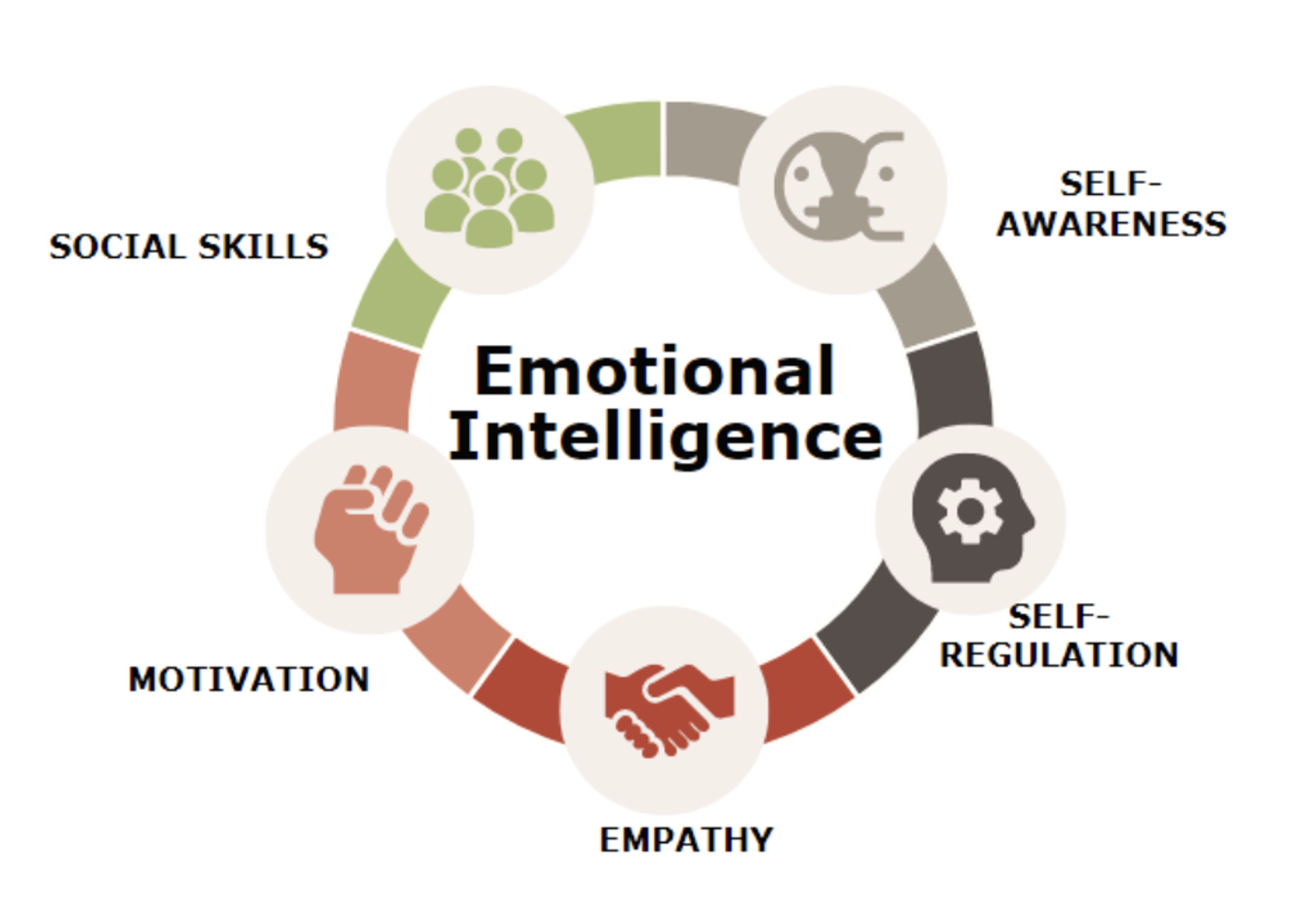

It is reasonable to accept that some CEOs and leaders have narcissistic personalities. They often suffer from a sense of self -interest, rights and surrounding often with managers, board members and advisers who are not willing to ask the difficult questions. It seems logical that headhunters and directors, when recommending and naming managers, need more focus on emotional intelligence, as illustrated below.

Emotional intelligence let go: master -feathering and adaptability at work

#CEOs #behave #poorly