Welcome to another exciting edition of Black Coffee, your unusual weekly digest of what’s going on in the world of money and personal finance.

I hope everyone has had a great week. And with that, let’s get straight to this week’s commentary, shall we?

The gold standard did not collapse; governments abolished these to pave the way for inflation. The whole grim apparatus of oppression and coercion had to be brought into action to destroy it. Solemn promises were broken, retroactive laws were promulgated, provisions of constitutions and bills were openly defied. And crowds of servile writers praised what governments had done and cheered the dawn of the fiat money millennium.

—Ludwig von Mises

Credits and debits

Credit: Have you seen this? Although U.S. rents have risen faster than paychecks in the wake of the pandemic, renters have regained some ground this year as much of the country rental prices are falling. As of the end of October, average monthly rent for units with up to two bedrooms is down 1.7% year-over-year to $1,696. That’s also 3.6% lower than their peak in 2022. Now for the bad news: That still doesn’t mean rents are affordable for many Americans. If you’re looking for that, you’ll have to live in China…

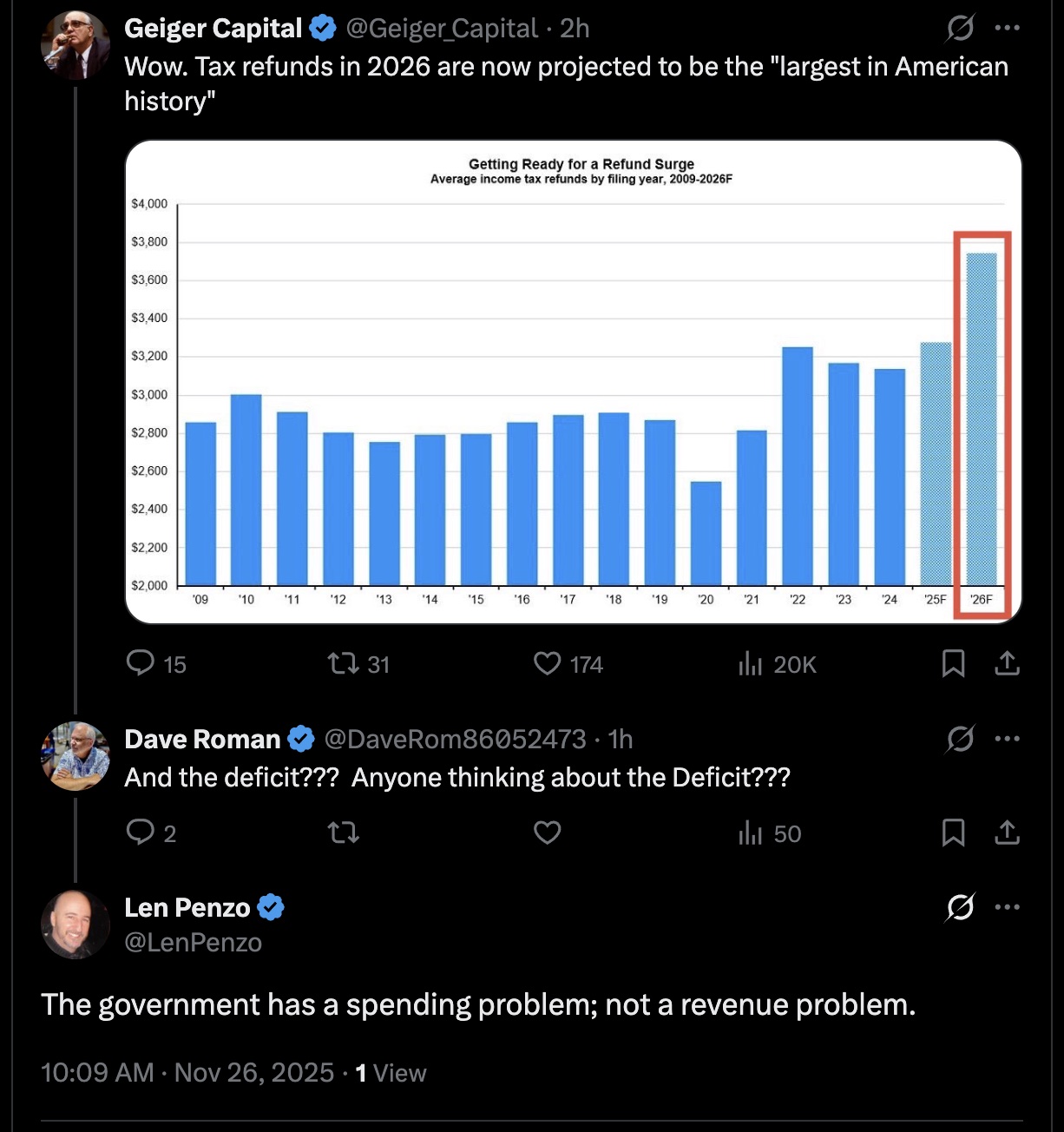

Debit: Rents may be falling, but people are still careful with their money. A new survey has shown that many consumers are looking for money 4% less these holidays than last year, citing higher costs of living and greater fears about the economy. This is the first time since 2021 that shoppers have indicated that they want to spend less than in previous years. Consumers earning less than $50,000 a year are expected to spend 12% less than last year, while consumers earning more than $200,000 a year say they will reduce their spending by 18%. And while the latter may seem counterintuitive, there be able to there must be a good reason for that…

Credit: In other news, only 1 in 5 baby boomers expect to leave a legacy, while the rest plan to spend their wealth instead during their lifetime. Factors contributing to this trend include the desire to enjoy their money, the high cost of living, inflation and significant expenses related to healthcare and long-term care after retirement. The point? This contrasts with many younger generations who expect to receive an inheritance… in some form or another.

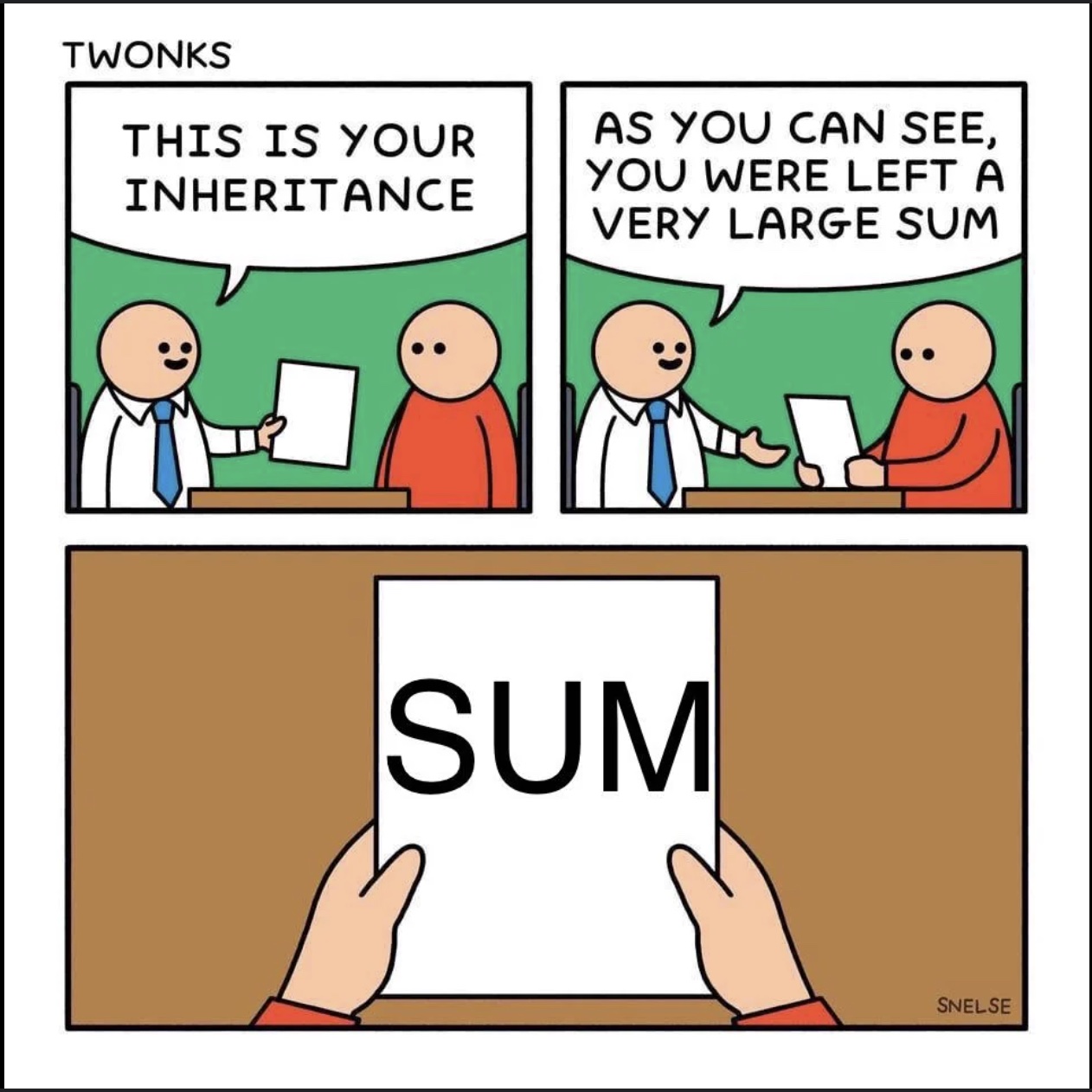

Debit: Honestly, who can blame a parent for not planning to leave a legacy to their children when a cheeseburger at McDonald’s is now more than three times as expensive as it was in 2019 and a medium order of fries costs more than $4? Or that a Big Mac used to cost that $2.25 in 2000 is over $6 today in most of America, including Massachusetts, where they sell for an average of $6.75. And to think, there was a time when McDonalds gave out $5 holiday gift books containing five $1 off coupons. When we were kids, those holiday books were good for several trips to the Golden Arches. It’s clear: not anymore.

McDonald’s circa 1975

Debit: It turns out that finances aren’t doing so well on the other side of the pond either, where a German federal official reported this week: “Almost every German city is now on the verge of bankruptcy.” He further pointed out that Germany’s largest state has only 10 of the 396 cities and municipalities that can present a balanced budget. He then added that these alarming numbers are not unique to that specific state and can be applied to the “entire country.” It seems that Germany is finally running out of money from others. That’s just one reason why silver closed more than 5% higher on Friday, ending at a new all-time high ($56).

Credit: Of course, the US is moving in the same direction as Germany, albeit at a slower pace thanks to a seemingly endless supply of other countries willing to buy its debt. But as macro analyst Sunil Reddy notes, “For decades, the Fed could always buy unlimited amounts of U.S. Treasury bonds, driving rates lower and prices higher. But that privilege depended on two conditions that no longer exist: 1) Inflation anchored near 2%; and 2) the undisputed role of the dollar as a global (reserve) currency – and both anchors are now gone.” True. And that’s bad news for most Americans. But honesty is always the best policy. Just ask these guys…

Credit: In response to the US throwing away its exorbitant monetary privileges, China launched the BRICS-linked Cross-Border Interbank Payments System (CIPS) several years ago as an alternative to the global trade regime. The CIPS has now been expanded 185 countriesallowing international payments in Chinese Yuan without using the US Dollar (USD). If this is true, the USD’s role as global currency king could finally be on its deathbed. Or not…

Credit: Unlike the fraudulent fiat currency that everyone has to use today, gold has no credit risk whatsoever; the yellow metal cannot be printed, riotous or defaulted. On the other hand, the ‘Almighty US Dollar’ (USD) is not money at all – they are debts. And unfortunately, as economist Daniel Lacalle notes, “the history of fiat currencies is always the same: first governments exceed their credit limits, then ignore all warning signs and eventually see the currency collapse.” Well… check the first two boxes.

Debit: Meanwhile, the US federal deficit exceeded $285 billion last month alone – if that pace continues, the deficit for the entire fiscal year 2026 will reach $3.4 trillion. With all that in mind, it should come as no surprise that China is openly buying gold as part of a de-dollarization strategy. While the official figures show that the Bank of China is holding up 5500 tons of the yellow metal, many analysts say China is deliberately underestimating its true gold reserves by more than 20,000 tons, if not more. In other words: the official figures are just an illusion…

Credit: Besides, the accumulation of gold by all the world’s central banks has been a major driver of the yellow metal ruthless wave That started several years ago, when policymakers were looking for both a store of value and greater asset diversification. Despite this steady accumulation, JP Morgan investment strategist Alex Wolf notes that gold as part of “foreign exchange reserves as an overall percentage is still relatively small” for many central banks. As a result, he says that “we still see them adding” to their current inventory no matter how high the price goes. Imagine that.

Credit: We conclude this review with a final observation from Mr. Reddy. He reminds us that “when spikes in risk aversion and leveraged positions are forcibly unwound, terrified money looks for assets with the greatest liquidity, the least counterparty risk, and the strongest institutional bid. From the 1980s until recently, that asset was unequivocally the U.S. Treasury bond. Today, that crown is gone forever unless something fundamental about the global monetary system is turned around: gold.” That is indeed true. How much of the yellow metal do you have?

By the numbers

This list of average price increases for some of McDonald’s most popular items between 2019 and 2025 illustrates how inflation has made fast food a very expensive luxury:

22% Cheeseburger (was: $1.00; now: $3.15)

63% Big Mac (was: $3.99; now: $6.50)

69% 10 pcs. Chicken McNuggets (was: $4.49; now: $7.58)

134% Medium fries (was: $1.79; now: $4.19)

202% McChicken sandwich (was: $1.29; now: $3.89)

Source: FoxNews

The question of the week

The results of last week’s survey

Did you celebrate Thanksgiving at home this year?

Yes 65%

No 35%

More than 2,100 Len Penzo dot Com readers responded to last week’s question, and it turns out that almost 2 in 3 of you spent the Thanksgiving holiday at home — which means you were probably also responsible for cooking the big dinner. Hopefully your meal was as delicious as mine! Pro tip: It’s hard to ruin the Thanksgiving turkey if you brine it first!

If You If you have a question that you would like to see here, please send it to me Len@LenPenzo.com and be sure to include “Question of the Week” in the subject line.

Useless news: goodbye, cruel world

Bruce was a lifelong environmentalist living in California. But he was fed up with the world and all the disturbing stories occupying today’s headlines. In fact, Bruce was so despondent that one day he drove his car into his garage and closed every doorway and window as best he could. Then he got back into his car, rolled down the windows, selected his favorite radio station, started the car and let it idle slowly…

A few days later, a concerned neighbor peered through Bruce’s garage window and saw him in the car. Stunned by what she saw, the neighbor alerted emergency services; they arrived quickly, broke into the garage and pulled Bruce out of the car.

The paramedics tending to Bruce gave him a small sip of water, happy to see that his condition was surprisingly good even though his Tesla had a dead battery.

(h/t: Boomer Earlier)

Squirrel Cam

This squirrel apparently tried to get our attention to let us know the picnic table was empty…

.

Buy me a coffee? Thank you very much!

For the best reading experience, I present all my fresh Black Coffee posts without ads. If you enjoyed this week’s column, buy me a cup of coffee! (Dunkin’ Donuts; not Starbucks.) Thank you very much!

.

More useless news

Hey, while you’re here, don’t forget to do the following:

1. Subscribe to my weekly Penzo dot Com newsletter only!

2. Make sure you follow me follow me on. And last but not least…

3. Please support this website purchasing my book! Thank you!!!! 😊

Thank you!!!! 😊

Letters, I get letters

Every week I post the most interesting question or comment, assuming I get one. And people who are lucky enough to have the only question in the mailbox will get their letter marked here, whether it is interesting or not! You can reach me at: Len@LenPenzo.com

After reading my list of 41 reasons why I don’t want to lend someone money, Joe left this comment:

Anyone who puts up with this crap to get clicks is a bigger loser than anyone I know who needs a few bucks every now and then.

Then why do I have a feeling that if I offered to lend you a few dollars, you would immediately change your mind?

If you liked this, please forward it to your friends and family. 😊

My name is Len Penzo and I approved this message.

Photo credit: public domain

#Black #coffee #king #dead #long #live #king