Want more stories from the housing market of Lance Lambert’sLubIn your inbox?Subscribeto the resic clubnewsletter.

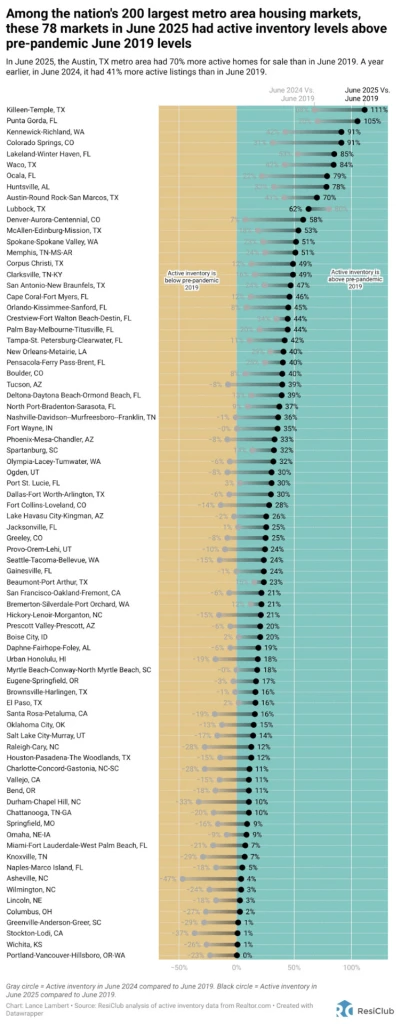

During the Pandemic Housing Tree, from summer 2020 to Spring 2022, the number of active houses plummeted for sale in most housing markets, while the demand for home buyers quickly absorbed almost everything that came for sale and sellers had ultimate electricity. Fast-Forward to the current housing market, and the places where active inventory has returned to 2019 levels (due to tense affordability that suppresses the buyer’s demand) are now the places where house buyers have gained the most power.

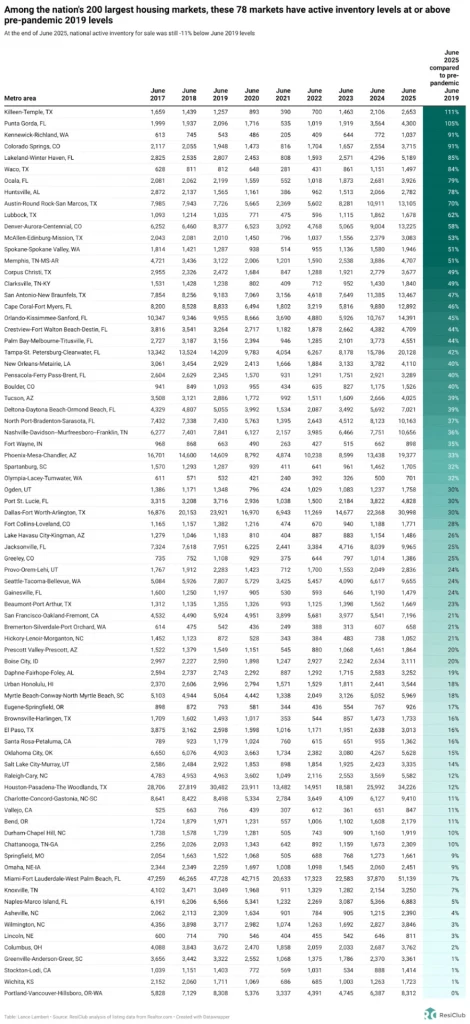

At the end of June 2025, the national active home inventory was still for sale -11% under June 2019 levels. More and more regional markets, however, surpass that threshold.

This list grows:

- January 2025: 41 of the 200 largest house markets for the metro area were back above the stock levels for the pre-Pandemische 2019.

- February 2025: 44 of the 200 largest house markets for the metro area were back above the stock levels for pre-Pandemische 2019.

- March 2025: 58 of the 200 largest house markets for the metro area were back above the stock levels for pre-Pandemische 2019.

- April 2025: 69 of the 200 largest house markets for the metro area were back above the stock levels for the pre-Pandemische 2019.

- May 2025: 75 Of these 200 most important markets, were back above the stock levels for the pre-Pandemische 2019.

Now, after the last lecture before the end of June 2025, 78 out of 200 markets above pre-Pandemische 2019 are stock levels and Lub Expect the count to rise this year.

This following table helps you to see what the stock image in the same 78 markets now looks like and what it looked like last year.

Under these 78 markets you will find a lot in Sun Belt -markets such as Florida, Texas, Arizona and Colorado.

Many of the softest housing markets, where home buyers have been given leverage, are located in Gulf Coast and Mountain West regions. Some of these areas were among the best Pandemic boomtowns in the country, which had experienced considerable house prices growth during the Pandemic Housing Tree, which stretched the Fundamentals from homes far beyond the local income levels.

When Pandemic Domestic Migration delayed and cut the mortgage interest, markets such as Cape Coral, Florida and San Antonio, Texas, were confronted with challenges because they had to rely on local incomes to support foamy house prices. The housing market that was softened in these areas was further accelerated by the abundance of new housing facilities in the pipeline over the Sun Belt. Builders in these regions are often willing to lower net effective prices or make other affordability adjustments to maintain sales. These adjustments to the new -build market also create a cooling effect on the resale market, because some buyers who may have opted for an existing home shift their focus to new houses where deals are still available.

Many Northeast and Midwest – on the other hand, were less dependent on pandemic migration and have less new housing in progress. With a lower exposure to that question of demand, the active inventory in these midwest and northeast regions has remained relatively tight, keeping the benefit in the hands of house sellers.

In general, housing markets where Inventaris (ie active entries) has returned to pre-Pandemic levels in the past 36 months experienced a softer/weaker house price growth (or outright decreases). Conversely, housing markets where Inventaris remains far below the pre-Pandemic levels have generally experienced more resilient house price growth in the last 36 months.

ResicLub Pro -members can find our latest stock analysis for +800 subways and +3,000 provinces hereAnd our newest analysis shows why the inventory comparison of 2019 remains clear here.

#housing #markets #critical #threshold #favor #home #buyers