Want more stories from the housing market of Lance Lambert’sLubIn your inbox?Subscribeto the resic clubnewsletter.

During Pandemic Housing, The demand for housing increased Quick in the midst of Ultralow interest rates, stimulans and the external work tree – which was the demand for space increased and “WFH -Arbitrage”, because high earners were able to keep their income from a job, NYC or LA, and buy in say Austin or Tampa. Federal Reserve researchers estimate “New construction should increase by around 300% to absorb the increase in the pandemic era.” Unlike the demand for housing, Housing stock is not that elastic And can’t rise so quickly. As a result, the increased pandemic era has removed the market of active inventory and overheated house prices, with American house prices Rise in a stunning 43.2% between March 2020 and June 2022.

Although many commentators consider active inventory and months of delivery as measures for ‘delivery’, RESICLUB sees them more as proxies for the balance for offering offer. Because the demand for housing is more elastic than housing stock, large fluctuations in active inventory or months of supply are usually powered by shifts in demand. During Pandemic Housing, for example, the increasing demand caused houses to sell faster – active inventory down, even when new entries remained stable. Conversely, in recent years, the weakening of demand has led to slower turnover, as a result of which active inventory has risen – even when new entries fell under the trend.

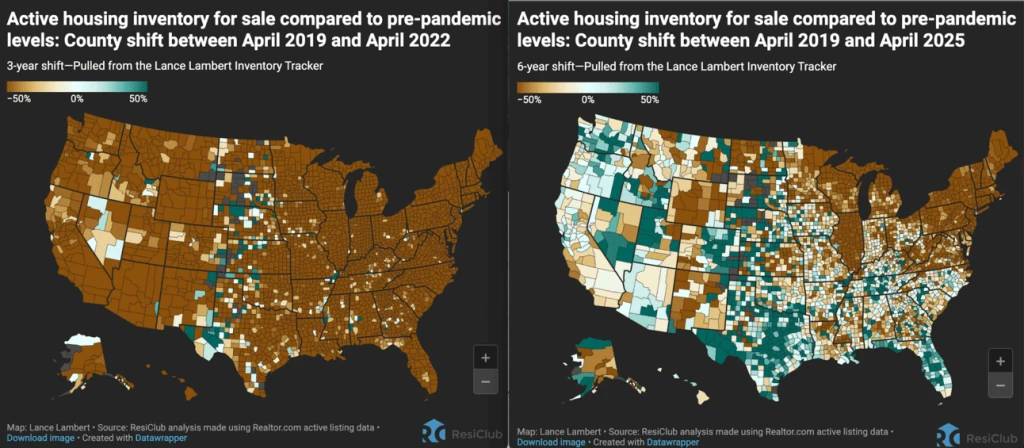

During the vorarious housing demand at the height of the Pandemic Housing in April 2022, almost the entire country was indeed at least -50% under pre -Pandemische 2019 active stock levels.

Brown = active home inventory for sale in April 2022 was under pre-pandemic 2019 levels

Green = active home inventory for sale in April 2022 was above pre-Pandemic 2019 level

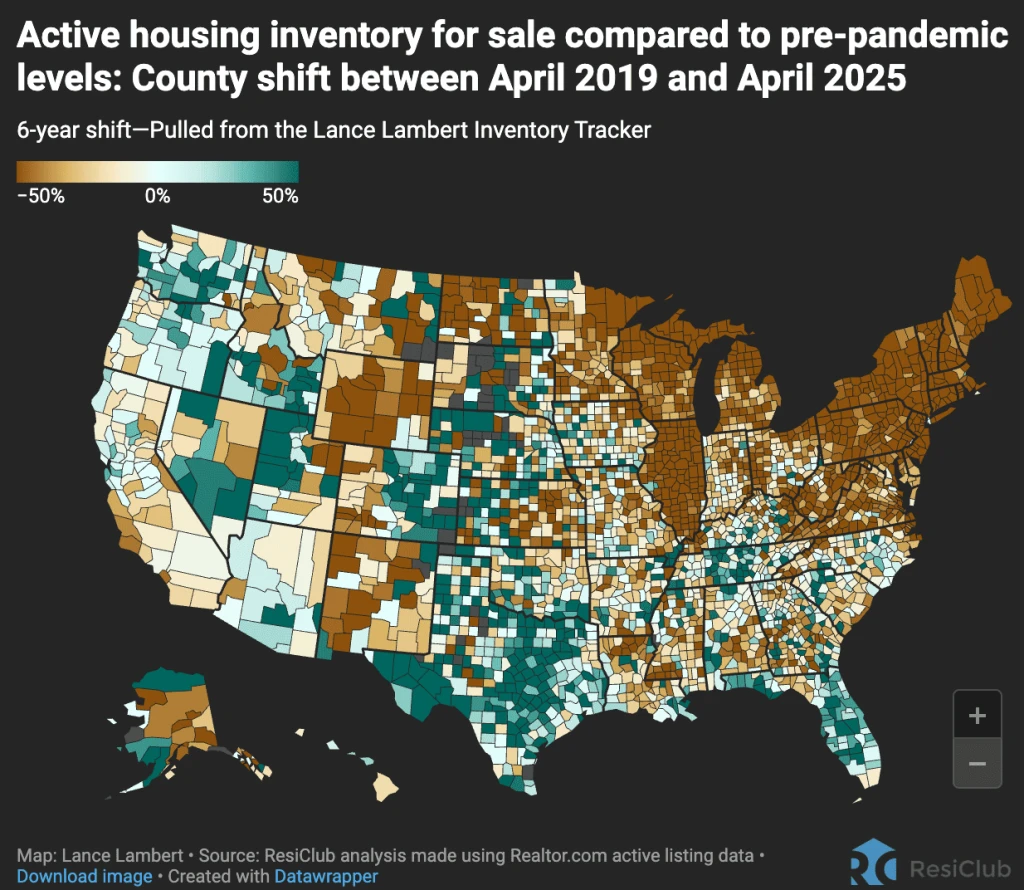

Of course it is now a different picture: the national active inventory has risen by several years.

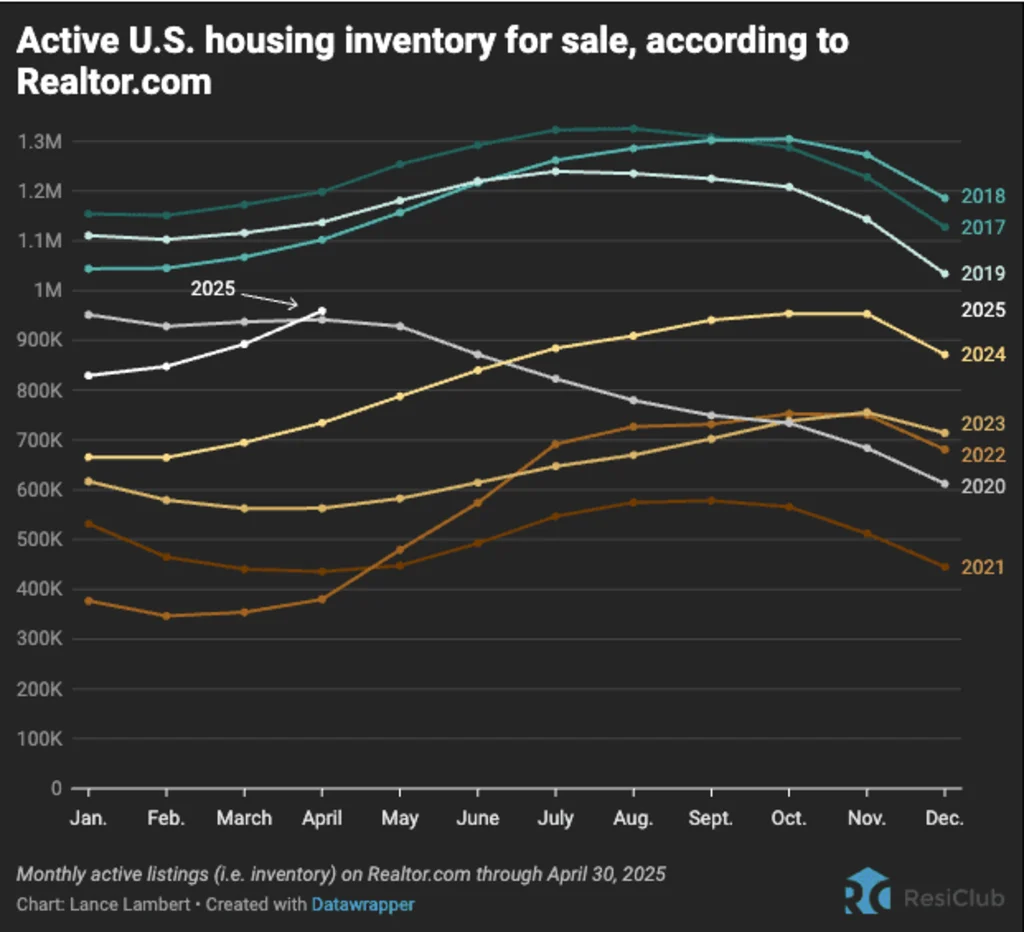

Not long after the mortgage interest rate was enriched in 2022 to pay the affordability to reflect the reality of the competitive house price increases during pandemic housing and return to the office, the national demand in the market for sale and the pandemic housing tree brutalized. Initially, in the second half of 2022, pulled the house demand pulled a “fever break” caused in a number of markets-in particular in speed-sensitive West Coast Housing Markets and in Pandemic Boomtowns such as Austin and BOise-Die active inventory pushed to Spike-in-Spijking and those markten in the second half in the market in the second half of the market.

On the way to 2023, many of the same Western and Pandemic Boomtown Markets (excluding Austin) were stabilized, because the spring season demand-with still tightly active stock levels feet to start the market temporarily. For a moment the national active inventory stopped on an annual basis on an annual basis.

However, that period of national stock stabilization did not last. In the midst of still business demand for housing, the national active inventory began to rise again-and we are now in the middle of an 18-month series of annual increases in national active mentions.

Where active inventory/months of delivery has risen the most, home buyers have received the most leverage. GenerallyHousing markets where Inventaris (ie active entries) has returned to Pre-Pandemisch 2019 levels have experienced weaker house price growth (or outright decreases) in the last 34 months. Conversely, housing markets where Inventaris have experienced stronger house price growth far under the pre-Pandemic 2019 levels in the past 34 months.

Brown = active home inventory for sale in April 2025 was under pre-pandemic 2019 levels

Green = active home inventory for sale in April 2025 was above pre-Pandemic 2019 level

As ResicLub has closely documented, that image varies considerably throughout the country: a large part of the northeast and midwest will remain under pre-Pandemic stock levels of 2019, while many parts of the mountainwest and gulf regions have been reflected back.

Many of the softest housing markets, where home buyers have been given leverage, are located in Gulf Coast and Mountain West regions. These areas were among the best Pandemic Boemtowns in the country and had experienced considerable growth in house prices during the Pandemic Housing Boom, which stretched the foundations of homes far beyond the local income levels. When Pandemic Domestic Migration delayed and cut the mortgage interest, markets such as Cape Coral, Florida and San Antonio, Texas, were confronted with challenges because they had to rely on local incomes to support foamy house prices. The softening of the housing market in these areas was further accelerated by higher levels of new housing facilities in the pipeline over the Sun Belt. Builders in these regions are often willing to lower prices or make other affordability adjustments to maintain the sale in a shifted environment. These adjustments to the new -build market also create a cooling effect on the resale market, because some buyers who may have opted for an existing home shift their focus to new houses where deals are still available.

Many Northeast and Midwest – on the other hand, were less dependent on pandemic migration and have less new housing in progress. With a lower exposure to that domestic migration – Pullback – and fewer builders who make large affordability adjustments to move the product – active inventory in these midwest and northeast regions remained relatively tight – where house sellers retain more power compared to their colleagues in the regions Gulf and Measinain West.

While National active inventory At the end of April 2025 was still -16% under pre -Pandemic April 2019, Lub Expect the national active inventory to surpass the pre-Pandemic 2019 levels later this year.

Big Picture: The housing market is still undergoing a process of standardization after the increase in housing demand during the flourishing of Pandemic housing, when house prices rise too fast, too fast. To date, that normalization process has pushed some markets-Including austin (mid-2022-present), Las Vegas (second half or 2022), Phoenix (second half or 2022), San Francisco (second half or 2022), Boise (202-2-23), Punta, Punta, Punta, Punta, Punta, Punta, Punta, Punta, Punta, Punta, Puntaa), Puntaa, Puntaa), Puntaa), Puntaaa), Puntaaa), Puntaaa). (2023-present), and tampa (2024 present) —into correction mode. In some other areas, it has so far ensured the growth of house prices. In the meantime, some markets are still tight and they have only seen a delay in the growth of the house price of the highlights of Pandemic Housing.

ResicLub Pro -members have access to my last monthly stock analysis (+800 subways and +3,000 provinces) hereand my last monthly house price analysis (+800 subways and +3,000 provinces) here.

#housing #market #shift #explained #fastest