In the past three years, every time the shares of IT -Majors – TCS, Infosys, Wipro – have risen, they have only done this to fall again in such a way that their return is largely flat in this period, while the Nifty has zoomed in 50%.

With the Nifty 50 on Friday 25,000 scales and his journey from reclaiming lost terrain from the peak of September 2024, investors continue to look in large IT shares from behind. In the past three years, every time the shares of IT -Majors – TCS, Infosys, Wipro – have risen, they have only done this to fall again in such a way that their return is largely flat in this period, while the Nifty has zoomed in 50 percent.

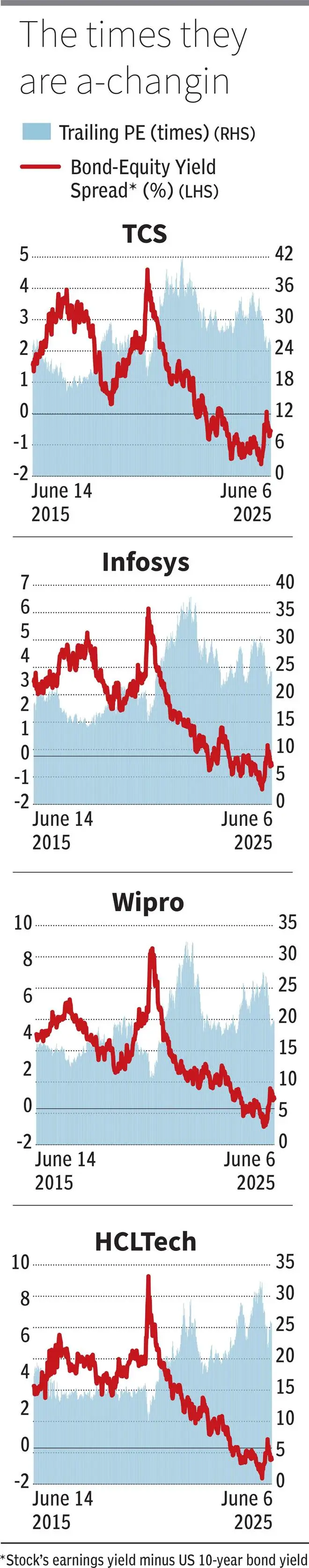

After this, investors would be tempted to think “is the correction about?” Although there has been a serious timely correction in shares, they are unfortunately with one metric in their most expensive zone in the past 10 years! This can continue to weigh on shareholders’ returns.

It’s all relative

The period since GFC caused the phase of the hunger of global investors to the proceeds because the interest rates in developed markets decreased to almost zero or even negative levels. Compared to a 10-year government bonds that yield 0 to 2 percent, even shares with PE of 30 times or profit yield (1/PE) of 3.3 percent (generally duration in the pre GFC era) suddenly seemed attractive. As long as the profit yield was above the return of the government bond and it also came up with considerable and consistent profit growth, such shares found strong favor. It has neatly applied to this place.

The graphs compare the return of the bond shares that spread for the IT shares from the perspective of a foreign investor, the profit revenue of the shares minus the American 10-year bond return, for the past 10 years. Due to this measure, although stock valuations (except HCLTech) have been considerably corrected by highlights, the irony is that they are floating on their most expensive levels on a relative basis in the past 10 years.

Take TCS – his PE is today where it was 10 years ago, but compared to other investable options from an FPI perspective, it is unattractive versus 10 years ago. Not only this, just as much on the unfavorable side, are the growth prospects today. In FY2015, TCS delivered a revenue growth of the Constant Currency (CC) of 17 percent that only justified a 25x PE in itself, making the attractive return of the bond-equile spread apart. On the contrary, the CC turnover growth in FY25 was only 4.2 percent.

Not only TCs, but also for his large contemporar-infosys, Wipro and HCLTech-Zal the period FY24-27 are among their worst period of three years in terms of growth. In this context, with bond returns worldwide increases and offers attractive yields, the FPIs can look beyond these shares.

Hunger for growth

In comparison with hunger for yields in the era of Lage Rentetareves, global investors now have hungry for growth. High payment ratios – as they are seen in IT -Majors who distribute the majority of their profit to shareholders instead of re -investing for the growth of new companies – worked well earlier, but can now put pressure on these companies.

Since their Core IT service company is confronted with GCCs, Mid-Cap IT players and, more importantly, AI-related disruption, the growth can remain faint. Slow growth For three consecutive years, there may also be a reflection of structural changes that go beyond cyclical factors.

Investors will be willing to buy shares/indices with a low or negative return on the bond equile distribution if the growth views are clear, but currently there is no for IT-Majors.

Published on June 7, 2025

#TCS #Infosys #Wipro #HCLTech #supply #collects #correction #collect #moss