The net direct taxing decreased by more than 1.3%, attributed to higher reimbursements, while the tax growth of the advance saw a decrease. | Photocredit: Istockphoto

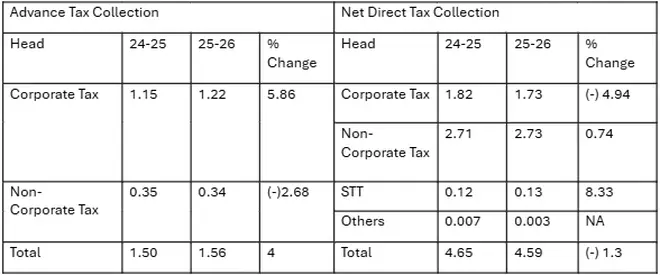

The first delivery of the information of prior taxes under direct taxes registered a growth of 4 percent during the tax year 2025-26 in contrast to more than 27 percent in the first delivery of the tax year 2024-25, data from the Income Tax Department.

With the decrease in prior tax growth, the net direct taxing saw a decrease of more than 1.3 percent. The Department has attributed the decline of the net collection to a higher reimbursement. “Restitutions have risen by 58.04 percent (as on 19 June 2025) compared to last year’s corresponding period as a representation of better taxpayers and faster issues of refunds,” said it.

In the meantime, the lower growth percentage prior to the tax prior to the dive in the dive of non-business taxpayers (including taxes paid by private individuals, Hindu undivided families, companies, organ of persons, local authorities and artificial legal person), as on 19 June, was approximately the last period of the last period of the last period of £ 35000. During the same period, however, the collection of corporation tax rose to around £ 1.22 Lakh Crore against £ 1.15 Lakh Crore.

Preference tax is the amount of income tax that is paid much in advance instead of a fixed payment at the end of the year. Every taxpayer with an estimated tax obligation of £ 10,000 or more in a financial year can pay the advance tax. Companies can pay an advance tax under the suspected tax scheme of section 44 AD on the income generated through their company. People aged 60 or older who have no income from a company or profession during the financial year are exempt from paying advance tax. However, seniors who have earned a business income in a financial year must pay advance tax.

Preference must be paid in four episodes. 15 percent of the total estimated tax obligation must be paid on or before 15 June. Deadline for the second episode is 15 and 45 percent of the total must be paid by that time. Similarly, December 15 and March 15 are replaced for two episodes respectively. Third delivery means that 75 percent of the total and fourth delivery implies the full amount to be paid.

Net direct taxing

In the meantime, the net direct taxing fell by more than 1.3 percent mainly due to dip in corporation tax. During this period, however, Securities Transaction Tax (STT) registered a great profit of more than 8 percent, mainly because of more activities on the stock market.

In the estimate of the budget (BE) of the tax year 2025-26, the corporation tax is estimated at £ 10.82 Lakh Crore (which indicates a growth of 10.4 percent compared to RE 2024-25). Taxes on income (excluding securities transaction tax) are estimated at £ 13.60 Lakh Crore in BE 2025-26 (a growth of 13.1 percent compared to RE 2024-25) with an implicit buoyancy of 1.30. The implicit buoyancy is lower than the average buoyancy of 1.74 obtained in the past five years (ending in FY 2023-24).

In general, the gross tax revenues (GTR) are estimated at £ 42.70 Lakh Crore in BE 2025-26. It represents a growth of 10.8 percent compared to RE 2024-25 with an implicit tax avoidance of 1.07. Direct taxes at £ 25.20 Lakh Crore make the most important contribution to GTR (59.0 percent of the GTR). Indirect taxes are estimated at 17.40 Lakh Crore.

More so

Published on June 21, 2025

#Prefaculate #tax #collection #growth #delivery