The delay is not random; It is driven by how foreign investors assess the risk and timing.

The influx of foreign money is an important factors that measure the strength of the markettrally. Foreign portfolio investors (FPIs) made the headlines when they buy or sell Indian shares. Buying the FPIs consistently in combination with a rally in the benchmark indices (Nifty 50, Sesex) can be a good convincing factor to pull the retail investors on the market.

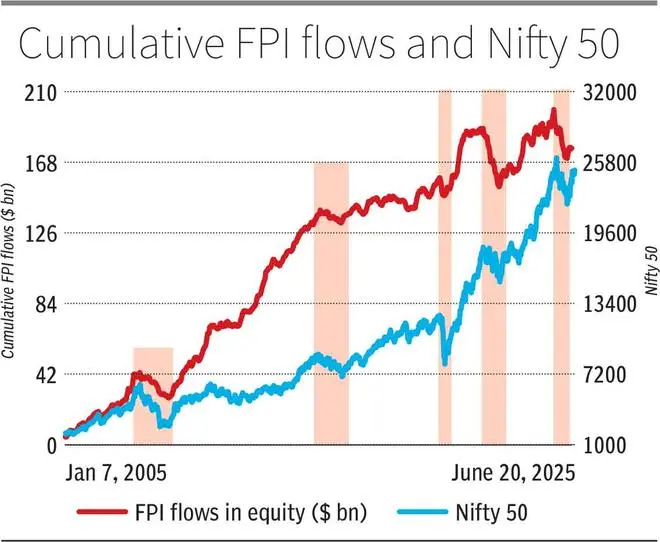

But after a correction, when you wait for a confirmation signal of the FPIs, you finally board the bus, you get a rear seat and miss the first row. That is what an analysis of 20 years of data shows. The Nifty 50, India’s popular equity -benchmark, is usually first at the bottom, while FPIs enter the market with a delay after some of the Upmove has already played.

To better understand this, we took the cumulative FPI flows (since 2005) to the Indian Equity segment and compared the same with Nifty. For example, in 2021-2022 Nifty fell from approximately 18,600 (October 2021) and released around 15,200 (mid-June 2022) before he went up. But the FPIs continued to sell Indian shares until mid -July before they returned to India. There was a net outflow of around $ 7 billion from mid-June, when the Nifty actually protruded, until the period from the mid-July.

Even during periods of major crises such as the Great Financial Crisis (GFC) of 2007-2009 and COVID-19 Deput, the pattern remained the same. Nifty was extended in GFC in October 2008. After that, the flat/range remained tied until March 2009 before it witnessed a new rally. Even during this consolidation period, the FPIs sold around $ 5.8 billion (from October 2008 to March 2009).

Explaining the delay

The delay is not random; It is driven by how foreign investors assess the risk and timing.

Bajaj Broking Research says that the FPIs often wait for confirmation of stability before they re-introduce and that delay creates a delay between market recovery and FPI intake.

Shrikant Chouhan, head of stock examination, Kotak Securities, says: “FPIs don’t wait when they sell. But they need some strong support and convincing factors to come back and buy. They don’t just buy because the market is doing well.”

What attracts FPIs

The Nifty rose from around 22,000 at the beginning of March this year to around 25,100. The FPIs also return to India, again after a delay. What has their comeback activated now? Harsh Gupta Madhusudan, Fund Manager-Pipe, Ionic Asset, says: “At the moment the dollar cycle is running and so the FPIs are coming back.”

According to Bajaj Broking Research, increasing the global risk-to-sentiment in combination with the weakness of the dollar is also the capital rotation back in emerging markets, including India.

Will the inflow persist?

The escalating conflict of Israel-Iran and the lack of complete clarity that prevail over the rates levied by the US are some of the most important uncertainties that the market now encounters. Will the FPI intake continue under such uncertain circumstances? Experts believe that the FPIs can be careful. “For two reasons, FPIs cannot accept an aggressive call. One, the ratings are now quite expensive. Secondly, the FPIs would wait until the deadline of 8 July to get a clear picture of the American rates,” says Shrikant. The 90-day break in the “mutual” rates of US President Donald Trump will end on July 8. “If the clarity arises earlier than the deadline or if the geopolitical tensions close it, the FPIs can also be little early interest in the neighborhood,” adds Shrikant.

However, data shows that as soon as the FPIs come back, they remain for the long term. So the recent reversal that is seen in both Nifty and the FPI flows can last a long time. “The Indian bullmarkt has more room to run. The business profit to the GDP cycle is best in the middle and the debt-to-equity cycle is at a very early stage. So the FPI flows will be for a long-term phenomenon and not for the short term,” says Harsh.

Published on June 21, 2025

#Nifty #moves #FPIs #follow