The efficacy of monetary transition Photocredit: Andrii Yalanskyi

After the policy repo rate has quickly reduced with 100 BPS since February 2025, the monetary policy has a very limited space to support growth under the current circumstances. “

These were important words in the Governor’s statement about the monetary policy in June. This also probably points to the limitations of monetary policy to push the growth beyond a point, because there are other factors that also have to fall.

In a facetious way it can be said that if the policy percentage brings through all central banks to zero, growth can stimulate, there should be high growth all over the world. But this is not how it works because the interest rates, with the support of transmission, can only influence the growth front to a certain extent.

Monetary transmission

The fundamental question is how does the transfer of monetary policy work? Lower rates for sent by banks makes higher loans by customers possible. But do you only borrow because the rates are low? A company will only borrow more if there is a need for investments that depends on the demand conditions. If there is a surplus capacity, borrowing may not be required.

Similarly, if a person is planning to buy a house or car, the capital costs will not be the rivet factor, although it can be a catalyst. When a housing loan is taken, there will be phases when the rates rise and fall and therefore the loan costs will vary over the 15-20 years of the loan.

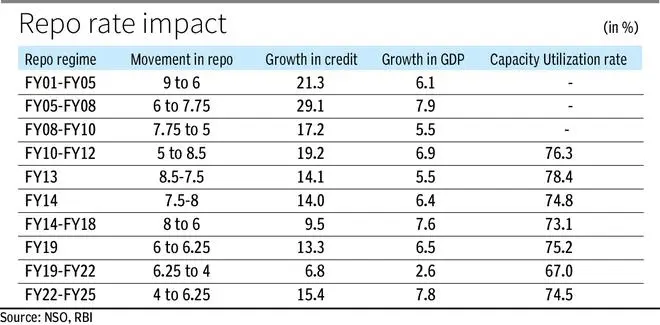

In this context it would be interesting to see how growth in credit and GDP has been in different interest rate in different interest rate in the past 20 years.

There were essentially 10 interest rates during this two decades, with some for just a year. The use of regimes has the advantage of taking into account the lagging effects of repo speeding changes on the growth of the credit if they entail longer periods of time, since most models talk about policy that works with a 3-4 quarter interruption.

The corresponding table provides the path of movement of Repo speed together with the average growth of credit and GDP during these periods.

As can be expected, the figures are ambiguous. Credit growth was high in the four regimes to FY12. In both regimes, however, when the REPO percentage was greatly increased by 175 BPS and 350 BPS respectively, GDP growth was higher by 29.1 percent and 19.2 percent respectively.

These were also phases when GDP growth was much higher than the two regimes when the repo speed was reduced by 300 BPS and 275 BPS respectively when the growth was 6.1 percent and 5.5 percent respectively.

That is why the feeling that people get is that the growth of credit is not linked to rates and investment opportunities is more. This was the time in which the investments on the back of high capital formation increased, especially in the infrastructure sectors.

The following two regimes can be kept aside because they concerned a few years and credit growth was flat by approximately 14 percent of a peak of 19.2 percent in the increasing tariff regime. The subsequent four regimes went against conventional economic wisdom.

During FY14-18, the Repo percentage was reduced by 200 BPS, but credit growth delayed to 9.5 percent, while the GDP growth was a peak of 7.6 percent. This was the time in which the AQR was introduced and bank loans were delayed while growing remained floating. FY19 was again a single year regime of marginal higher rates when credit growth was picked up.

The last two regimes are interesting. The FY19-22 period was characterized by the lowest repo speed and yet credit growth was low by 6.8 percent with GDP growth of 2.8 percent on average. It was clear that this was a case of shooting the question, which led to a lower growth of credit. It was obvious that during Covid investment decisions were postponed. This was reversed in the period of FY22-FY25 when the rates rose, but with the GDP growth-growing steam did not get in the way of rapid growth of credit.

The question side

That is why there is reason to believe that the impact of the interest rate on the growth of the credit and GDP cannot be viewed with a single lens and the question -Neeven factor must also be entered. An indicator of demand is the capacity use in the industry.

Data is not available for the first three interest rategimes. The average capacity -use rate for the various regimes is presented in the last column based on RBI data. This rate indicates the increase or decrease in demand because it reflects the reserve capacity in the industry. Admittedly, capacity use only relates to production and no services or the personal loan segments.

The trend for capacity use is quite unambiguous. When the capacity -use rate rises, there is a tendency to pick up credit growth and vice versa. This shows that interest rate is an aid to stimulate credit growth, but also depends on how the question story evolves. As the capacity -use rates improve, there is a tendency for the demand for credit to increase both working capital and investment purposes.

It can therefore be concluded that the statement of the RBI is an honest with regard to the impact that interest rates can have on growth, even if it is assumed that inflation will remain benign in view of the supply of secondary factors with regard to food products.

In two of the three phases with a high GDP growth, the repo speed had increased, while in the third, the policy percentage fell, but credit growth was in one digit. In the other four phases of lower repo speeds, GDP growth was low and the highest was reached 6.1 percent in the period FY01-FY05. That is why the demand side of the story must also play.

The writer is chief economist, bank or baroda. Expenses are pronounced personal

Published on July 12, 2025

#interest #rates #stimulate #growth