Australian banks have so far launched their most important anti-fraud initiative and reveal a name-matching technology of $ 100 million that is designed to prevent customers from accidentally sending money to scammers before it is too late.

The new “confirmation of the beneficiary” service represents the newest weapon of the banking sector in an escalating fight against increasingly advanced fraud programs that Australians have cost hundreds of millions of dollars in recent years.

How the technology works

The system automatically activates when customers make first payments using BSB and account numbers, creating leaders in the industry as a crucial verification step that takes place before money leaves the bill of a customer.

Adrian Lovney, Chief Payments and Schemes Officer at Australian Payments Plus, who developed the service, explained the simple but powerful concept behind the technology.

“Confirmation of the beneficiary helps to reduce scams and incorrect payments by checking whether the name, BSB and account number entered by a customer corresponds to the account details of the receiving bank and display the match result before the payment is made,” Lovney said.

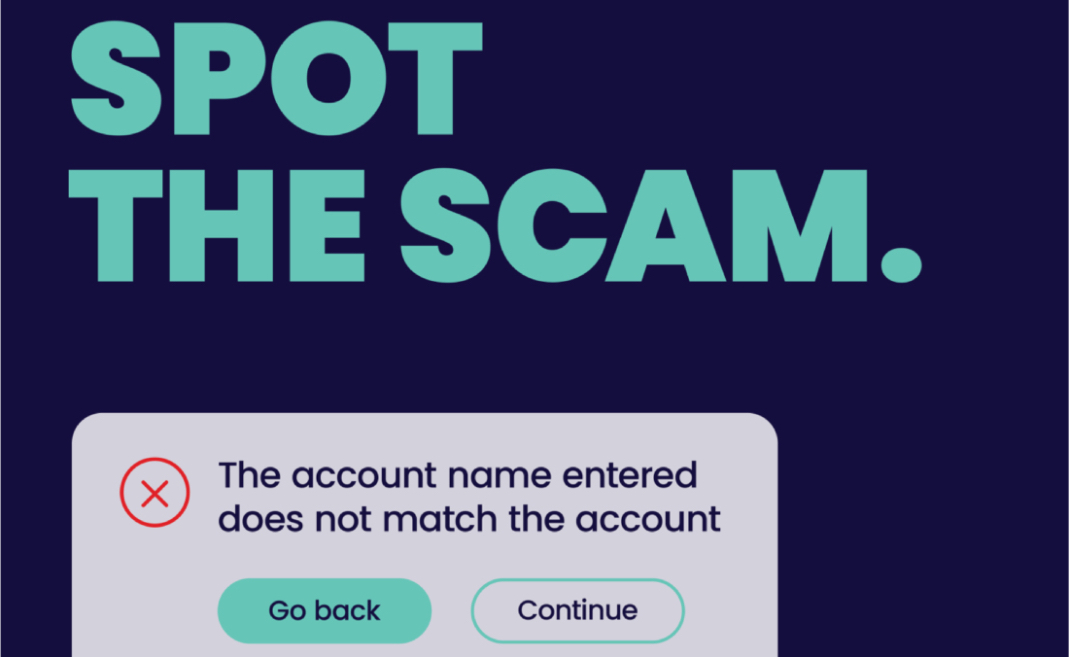

The service offers customers three possible results when making a payment. If the details match perfectly, the account name is displayed for confirmation, so that customers are confident that they will send money to the right person. If there is a narrow match – such as “John Smyth” instead of “John Smith” – customers will see the account name and be able to confirm whether it is correct.

For individual accounts where there is no match at all, customers receive a warning and the account name is not displayed to protect privacy. Business and government accounts can still display the account name, even without a perfect match.

“It is a simple concept, but it adds a powerful extra protective layer for daily transactions,” Lovney emphasized.

With the help of this information, customers can then make a well -considered decision about the fact that they continue to pay, pause to check the details or to stop the transaction completely.

Part of a broader initiative for combating scam

The rollout of technology is a cornerstone of the bench sector’s bench sector, described by industrial officials as an extensive set of world leading guarantees that have been designed to protect Australian consumers against fraud. CEO of Australian Banking Association Anna Bligh positioned the initiative in the context of the relatively strong performance of Australia in combating scam losses compared to other countries, while the need for continuous vigilance is recognized.

“While Australia was one of the few countries in the world where the loss of scam decreased, it was further investing in the latest SCAM Fighting Technology crucial for managing losses,” Bligh said.

The bank head emphasized the potential impact of technology on the prevention of successful fraud attempts. “This is crucial new technology that will help a customer protect against transferring money immediately in the hands of a scammer,” she said. “It is a new weapon that banks have at their disposal to better protect customers in losing money to scams.”

The extensive rollout in the entire banking sector of Australia will place the country among worldwide leaders in the implementation of anti-fraud fighting, according to representatives of the industry. Bligh emphasized the importance of the sector -wide approach and provided consistent protection, regardless of what customers use of financial institutions.

“When the rollout is completed, Australia will be one of the few countries to have this technology in the entire banking sector, which protects customers, regardless of who they bank. It is also proof that Australian banks are at the forefront when it comes to protecting customers,” she said.

The Banking Association of the customer has also thrown its support behind the initiative, with chairman Elizabeth Crouch describing it as an important progress in the measures of customer protection.

“The mutual banks of Australia are working hard to protect the money from their customers and the new confirmation of the beneficiary service is a big leap forward,” said Crouch.

She emphasized the cooperation character of the initiative and its coordination with the values of customer ownership.

“Developed as part of the SCAFe Accord of the banking sector, this crucial solution for name-matching is rolled out by all banks to deliver stronger guarantees against scams,” Crouch explained.

“Banks in the customer have put their customers first and are committed to do everything they can to offer effective fraud and scam protection that work for their customers and communities.”

In addition to the rollout of the technology, banks are launching a national awareness campaign under the slogan “Check the name. View the scam” to inform customers about the new protective measures and how to use it effectively.

The campaign represents recognition that technology is not sufficient to combat advanced fraud schemes, and that customer education plays a crucial role in maximizing the effectiveness of new protective measures.

Growing scam threat

The launch of the beneficiary’s confirmation comes when Australian consumers are confronted with increasingly advanced swindles that have evolved much further than traditional phishing schemes. Modern scammers often use social engineering techniques, fake websites and extensive stories to convince victims to voluntarily transfer money to fraudulent accounts.

The name-matching technology is designed to create a moment of verification that can prevent much of this successful scams, in particular those where criminals offer fake or somewhat changed account names to receive payments.

Future of fraud prevention

The investment of $ 100 million in confirming the beneficiary’s technology indicates the dedication of the banking sector to remain ahead of evolving fraud threats. As scammers continue to develop new techniques, the reaction of the financial sector has evolved from reactive measures to proactive prevention systems.

The success of this initiative could pave the way for extra technological guarantees, because banks try to maintain Australia’s position as a world leader in fraud prevention and at the same time protect the billions of dollars that flow through the payment system daily.

For customers, the new technology promises more peace of mind when making electronic payments, knowing that there is an extra verification layer between them and potential scammers who want to exploit their trust and steal their money.

Stay informed of our stories LinkedIn” Twitter” Facebook And Instagram.

#Banks #add #speed #bump #prevent #sending #money #Crooks