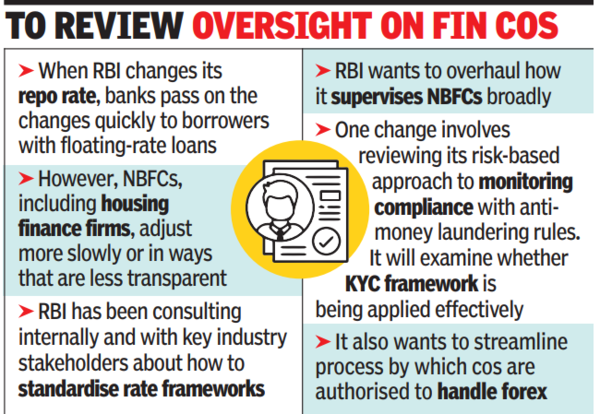

Mumbai: RBI wants to introduce interest rate as rules for non-bank financing companies that are comparable to those banks rule. The aim is to improve how changes in monetary policy go to borrowers and to make loan prices more transparent.From now on, when RBI changes its Benchmark Repo rate, banks quickly pass on the changes to borrowers with loans with floating speeds. However, NBFCs, including housing financing companies, adapt more slowly or in ways that are less transparent. “The existing regulations for interest rates on the advances vary between all regulated entities,” said RBI. “To harmonize the same, an extensive overview of the existing regulation instructions is underway.“RBI has consultations internally and with important stakeholders in the industry about standardizing interest frames. “In order to ask for wider public feedback, it is proposed to publish a discussion document that the various imperatives patch up from moving to a harmonized regime for interest rates on loans and advances in all regulated entities,” the Central Bank said in its annual report.

Analysts say that the current system creates gaps in supervision. “Banks have a repo rate-linked loans, MCLR (marginal costs of loans) loans, etc., all of which are well defined and RBI can keep track of how transmission takes place,” said Suresh Ganapathy of Macquaria. “NBFCs do not have these repo-linked or MCLR loans and they praise their loans from an outdated PLR (Prime Lending Rate) concept. Of course, final prices will ultimately be determined by competitive powers. That said, this entire process is super opaque and that is why it is essential to coordinate, “Ganapathy added.RBI also wants to revise how the NBFCs are broadly supervising. One change includes the revision of the risk-based approach to follow compliance with anti-money laundering practices. It will investigate whether the KYC framework is applied effectively, especially for companies with a higher risk.The supervisor is also planning a thematic assessment to ensure that NBFCs follow interest rate lines, in particular to prevent customers from being charged excess rates. At the same time, it studies how you can bring more NBFCs under a risk -based supervision model, whereby the attention of the regulations depends on the complexity and the risk profile of each company. RBI is also planning to simplify rules for borrowing and borrowing in rupees and to streamline the process with which companies are authorized to handle foreign currencies under the foreign exchange legislation of India.

#RBI #Eyes #Bank #tariff #standards #NBFCs #connect #policies #Times #India