File photo: the German share price index Dax graph depicted in the exhibition in Frankfurt, Germany. After a long time, the Dax index came forward as one of the surprisingly best artists. This reflects renewed optimism in the German economy, which is undergoing a reset. | Photoredit: Staff

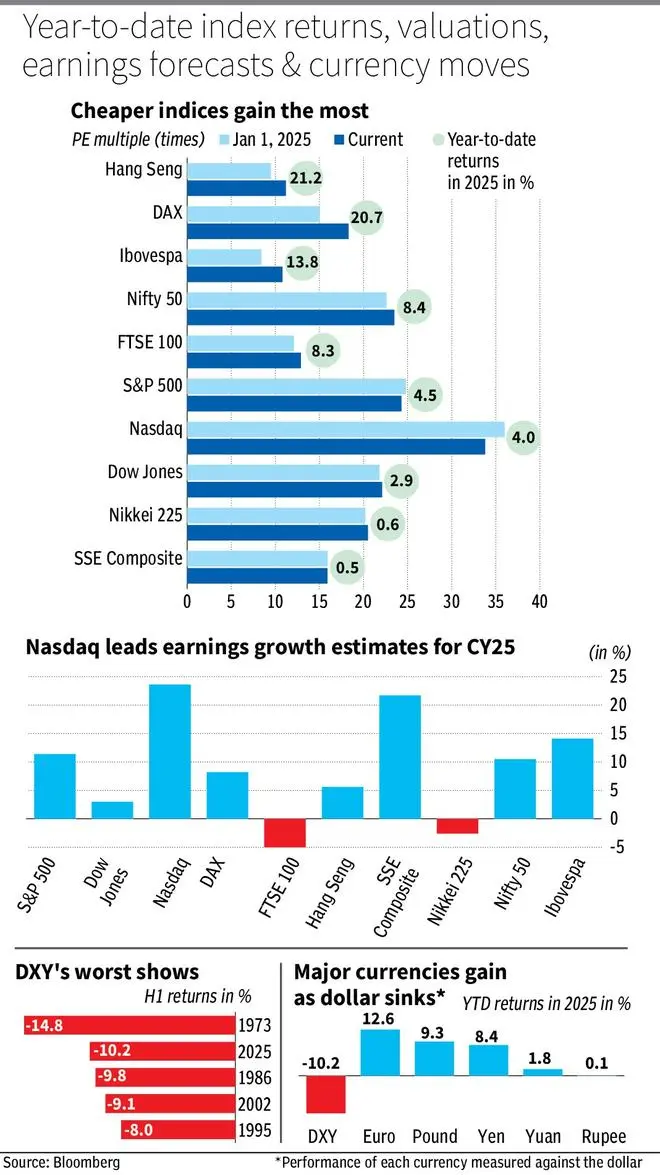

If you had gone into hibernation on January 1 and just woke up, you can assume that the world markets, especially the US, had had a smooth ride in H1 of 2025. For example, the 2.9 percent, 4.51 percent and 4 percent return for the indices that have seen the indices in a six-month period.

In the first week of April, S&P 500 and Nasdaq saw their third worst two -day performance in 20 years on the lines of volatility that witnessed during the global financial crisis.

In the midst of these turbulences, some unlikely winners and losers in shares and currencies are the story of this year’s H1.

US, Europe Schakel of Place

While AI, Magnificent Seven and US Exceptionalism were the euphoric themes at the start of the year, the 20.7 percent return for the Dax index of Germany in reality makes it one of the surprisingly best artists after a long time. This reflects renewed optimism in the German economy, which is undergoing a reset. As part of a plan of € 800 billion, the EU has lifted the rule that requires members to keep budget deficits under 3 percent of GDP.

Germany followed the example, in which the Bundestag voted to reform the Debtbremse – a constitutional “debtdrem” that limited the budget deficit to 0.35 percent of GDP, established in 2009 after the global financial crisis. With this reform and plans to increase and spend more shortages, German shares found favor like never before. These actions have entirely in the context of the tariff war -related concerns.

Even after this out performance, the Dax still remains one of the cheapest large index on a PE of 18.2 times. This also applies to the Chinese Hang Seng, the best performer YTD. It acts on a PE of 11.22 times. In fact, at the start of the year – iBovespa, Hang Seng, FTSE 100 and Dax – the best artists are the cheapest large indices at global indices.

When it comes to currencies, while the dollar remains the global reserve currency, the dollarization seemed to get a grip. The Dollar Index (DXY) fell by 10.2 percent in H1 2025, the steepest fall of six months since June 1973, while the euro had surprisingly one of the best six months. Other large currencies have also appreciated the dollar, in contrast to last year when the dollar was in force alone.

What awaits us

One of the most remarkable features is how many markets have returned from the lows. For example, the Nasdaq composite has risen 32.78 percent compared to the tariff war. India’s Nifty 50 has risen by 16.1 percent. But compared to the start of the year, the uncertainties are only much higher, whether it is the tariff war, geopolitics or delay in the American economy after the tree years after Covid.

So a lot will depend on how profit growth is going on. Some of the tariff war -related effects will first be seen in the coming profit of June.

The H2 of the year will reveal two important things or markets about tariff wars and, more importantly, whether the de-dollarization process is for real or still a myth.

Published on June 28, 2025

#Dow #Jones #Nasdaq #Composite #Dax #Hang #Seng #Nifty #Redefining #Surprise #winners